GE – A New Financial Cow for Our Growing Herd

Well, our milk-the-cow strategy has been going strong this year, after developing the strategy and working out the kinks in paper-based and live trading over the last 3 years. So we've decided to add a new cow to our growing herd, namely General Electric (GE).

For my smaller investors, I needed to find a stock that did not require a lot of margin, that offered an attractive rate of retail/wholesale options cost, that offered high frequency of options contracts (weeklies, preferably), and equally important, that offered low bid/ask spreads. These are all criteria for choosing a good candidate to generate maximum income from a strategy based on rolling options.

At around $6.00 a share, I could establish a long term strangle (buying out of the money puts and calls) for $4.10 per share or $410 per contract.

This puts an outer limit at possible losses if I am careful not to lose money on my frequent option rolls (milking my cow).

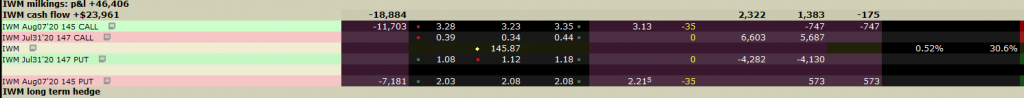

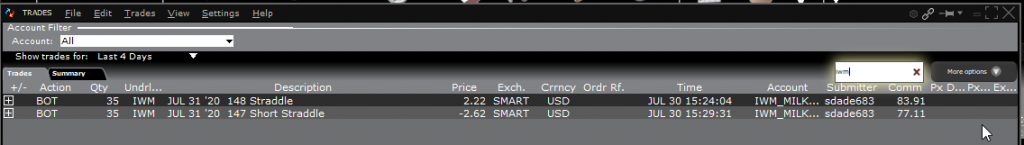

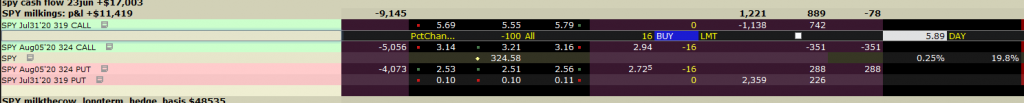

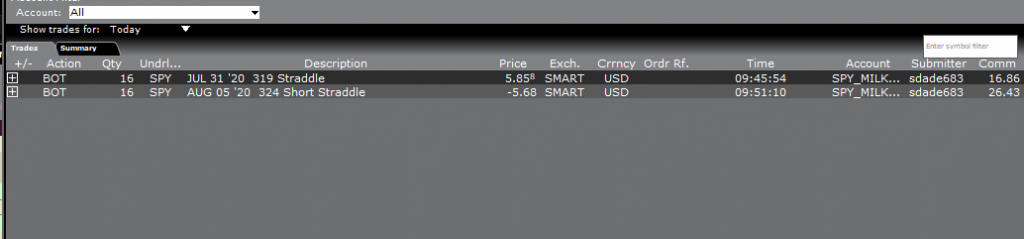

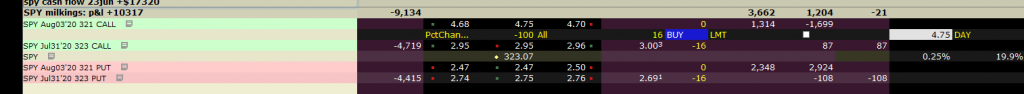

I sold my first at the money puts and calls on the same day at a 6.00 strike. Later that day I had to buy them back at a loss to reset the straddle to $6.50. I did so by rolling from the original July 31 sold strikes to Aug 7 sold strikes. This created a $9.50 loss per contract but a positive cash flow of $15.41.

As I'm writing this, on the next day, the stock has not moved much, but the options positions have turned profitable. The currently have a positive value of $209 if I were to close them.

size: 41 contracts

Long Term Hedge: $4,510 or $1.10 per share

Cash Flow to Date: $650 or $0.07 per share

P&L to date : ($95) or ($0.02) per share