ARKK status 22 July

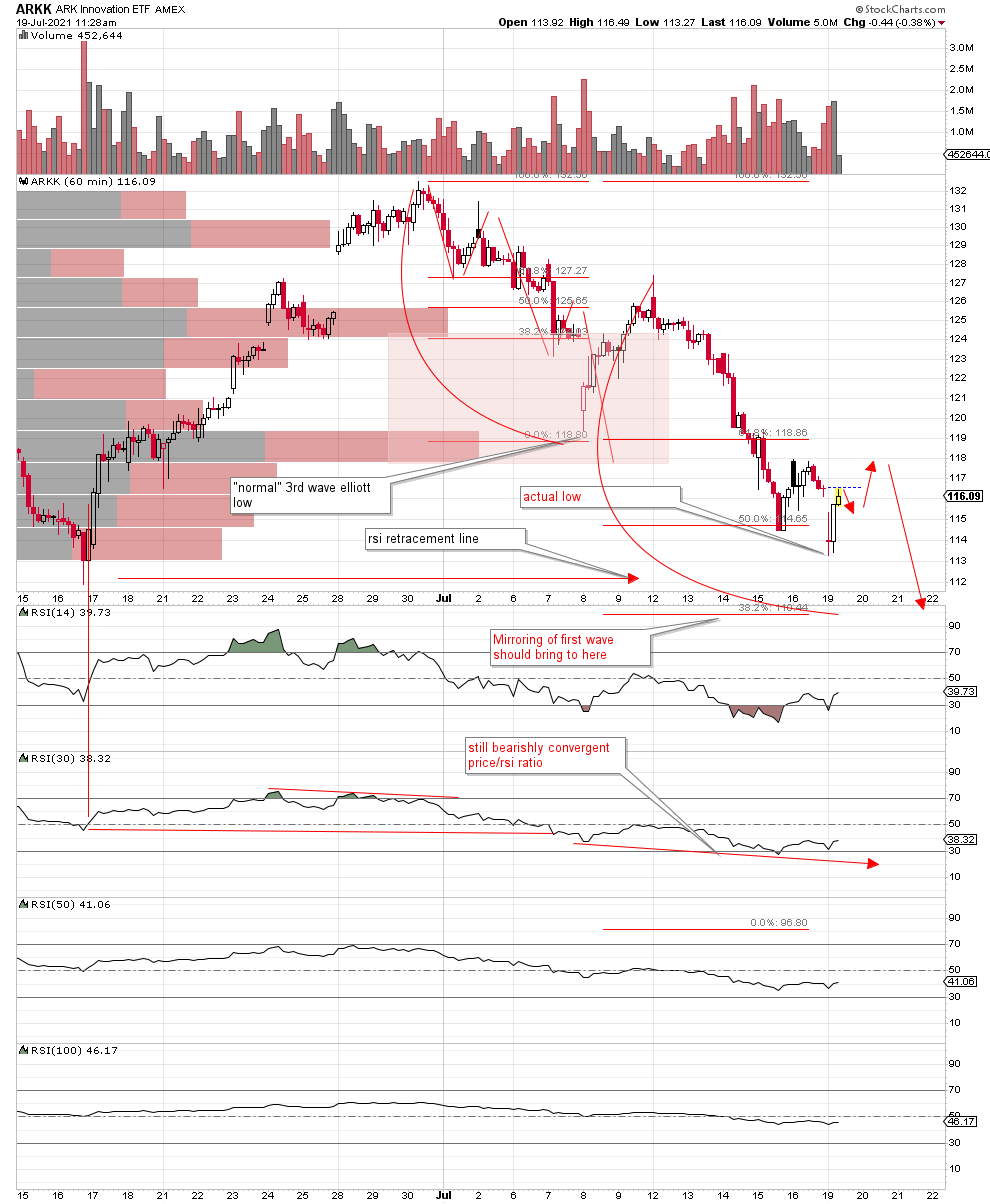

ARKK has rebounded well today, moving past recent highs. This does not change my prognosis.

I see the ETF moving all the way up to $123 over the next 2 to 3 days. Then I still expect a drop.

That said, it may never end up in the $85-110 range that would be optimal for our calendar by Aug 6. Since I've got around $21 at risk in each of my 80 positions, that would not be horrible.

But still, why not bring down that risk even more?

Since I'm reasonably sure the stock will move opposite my wishes for the next few days, I'll bring in premium by selling some put spreads. I'll sell the 115/114 puts expiring on July 23, using a limit order. I think I can get filled at $0.10 to $0.14 cents which will bring in $10-14 for each position.

This increases my risk of loss to $86 ($100 spread minus premium collected) instead of my original $21 of max risk. Still the market has revealed its hand, and I will choose to play it. I think the spreads will expire worthless and I'll have reduced my overall costs to $11.