SPY Milkings 31 July

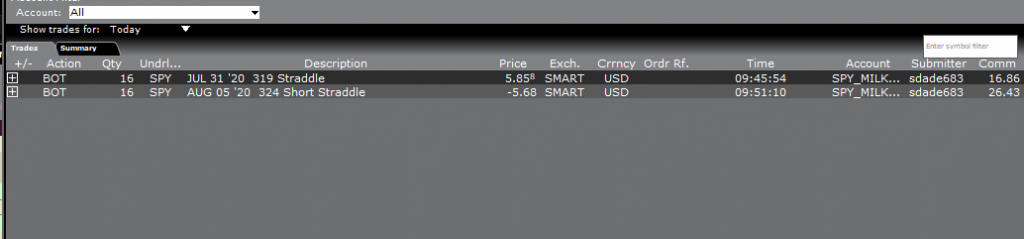

SPY gapped up 4 points this morning on positive earnings reports from the FANG stocks, which represent a big portion of the economy. This placed out positions, centered on $319 in anticipation of a possible drop to support there, deep under water on the call side. Despite that, we were quite profitable on the positions, due to the effect of time erosion on these weekly options.

We immediately rolled, rather than waiting for further time erosion. That is because I don't want the margin impact that would result from the calls being exercised before the end of the day, which can happen, though it is infrequent. By doing it early I am foregoing high time erosion in the morning hours, but boosting my control of the margin environment. Those are trade-offs one needs to weigh.

Note: A possibly more lucrative and nuanced approach would be to just roll the threatened call side to the higher level extending it by one week, but to wait until the jul 31 Put loses all value by mid-day or so in order to only roll that one at that time. In my case I have many other positions to roll and other investing decisions to make, so the perfect became the enemy of the good. I preferred to sin on the side of making smaller profits but not having to scramble later to figure out how to reduce my spiked margin requirements.

If SPY moves back higher today, we may even choose to roll a second time. But for now, we've rolled out our positions one week in time.

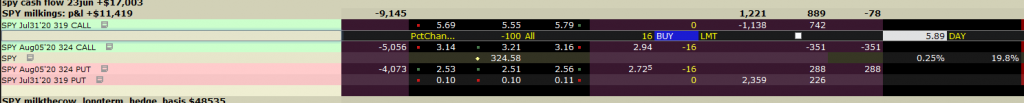

We've boosted profits by $1221 to an overall today of $13,640 on 16 contracts and sacrificed only $317 of cash flow, while re-centering our

straddle by 4 entire points.

size: 16 contracts

basis $48,535 or $28.56 / share

cash flow $17,003 $10.62 / share

p&l $10,317 or $8.52 /share