IWM – Roll 27JUL

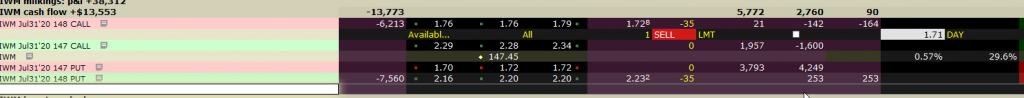

At the last minute, a break of IWM to a higher high caused me to roll the Aug 3 147 PUT/CALL straddle into a 148 PUT/CALL straddle. I had not intended to do so, as the options were centered close to the market price, but I detected a breach of higher highs suggesting the market could rise to 148 by tomorrow.

The positions were profitable, so it was an easy roll. In fact, I decidedto roll them forward in time, to the calls expiring in 4 days, on July 31 from August 3. This sacrifices a bit of cash flow, but those new options should produce better time decay for us, thereby increasing our ultimate milked earnings.

size: 35 contracts

Long Term Hedge: $93,159 or $2,661.68 per contract

Cash Flow to Date: $13,553 or $387.22 per contract

P&L to date : $38,372 or $1,096.34 per contract