IWM

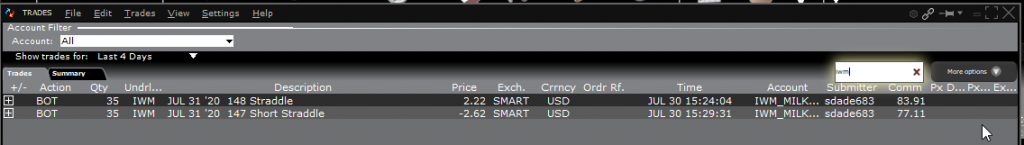

IWM has not moved a lot, but we chose to roll from 148 strikes to 147 strikes to slightly improve our theta erosion on the sold options.

This is also because technical analysis suggests the stock will move to that level today or tomorrow. If we're right, doing so now will bring in more overall premium. Conversely, if we're wrong it will diminish that revenue, so this is not a neutral decision.

Doing so booked a profit of $5772 on our 35 contracts. We sacrificed $1561 in cash flow, but we still have ample positive cash flow reserves.

size: 35 contracts

Long Term Hedge: $93,159 or $2,66 per share

Cash Flow to Date: $11,992 or $3.42 per share

P&L to date : $44,084 or $12.59 per share