The Corona Virus May Kill You or Make You Money

The world is being ravaged by the corona virus. As I write this it has spread to 56 countries in two months, sickening more than 90,000 people and causing over 3000 deaths. Though as many people die from influenza, corona has been demonstrated to have about 1000 times the infectiousness. It has already humbled China's economy, forcing 10% of humanity into a quarantine.

Click images to expand

Scientists are racing to find a vaccine, but possible vaccines are about 1 year away. Currently, only a handful of treatments show any sign of allowing doctors to treat the severe pneumonia that results from the disease, though nothing it for sure yet.

The leading candidate for an effective treatment (not a vaccine) is Remdesivir, a product under development by Gilead Sciences. I don't know if Remdesivir will perform well, but early indications are that it will. I prefer to buy the rumor. If I wait for proof, from a stock perspective it will be too late.

Readers may want to refer to the following article (and the comments) on Seeking Alpha for the background on the drug. Gilead: Remdesivir's Potential Most Dependent On COVID-19 Spread I'm focusing here on a bullish play, betting that the stock will rise sharply over the next weeks and months.

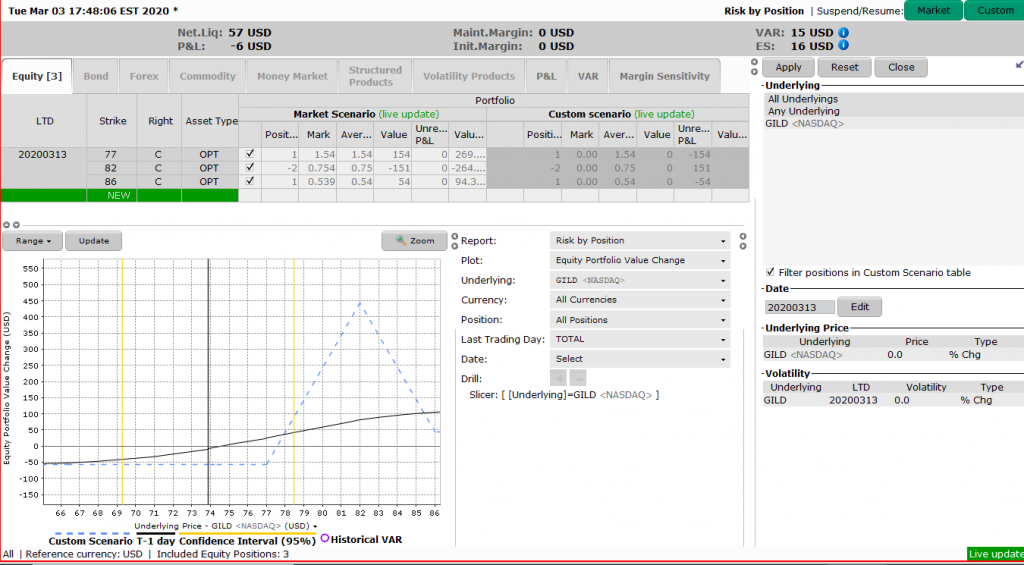

I have developed a speculative play using what I call a "lopsided butterfly" option play. This is like a traditionial butterfly, but I stack it in favor of the direction I expect the stock to move. This allows me to benefit from the passage of time, disregard volatility calculations - as it is neutral to volatility fluctuations (always a tricky area with options), and requires little margin.

If properly executed the following option has a defined risk for around $57 per position. If I'm correct in my fibonacci/elliot wave calculations and time projections, the stock should reach $82 by the end of this week or the middle of next week. This option expires worthless if the stock does not move by the 13 th of March. Watch out! That's a Friday for those among you who are superstitious...

So if I'm correct, I could make between $300 and $450. If I'm wrong, I lose $57. I like those odds.

If you believe the mathematical probability statistics (the yellow lines) I've got only about a 10% chance of ending up in the money,and making a profit. Obviously, those are poor odds, if they were correct. But those lines and prices represent GILD's price movements in the past. They know nothing of the unique situation that has evolved since the corona outbreak. I've learned to trust my technical calculations more than the options' software. I think I have better than even chances of being right. Time will tell.

Click images to expand

As always, please read our disclaimer. Options trading is very risky if performed by the inexpert. Consult with a professional before investing, or you could lose everything.