Like Those Stock Buys ? Use Options Instead!

I was called today be a buddy of mine who has a keen eye for stock plays, and is of a conservative bent. We both agree that this stock market is not yet ready to soar, although it has temporarily found a bottom. We both think it's going to rally a bit on recent government interventions, only to falter a few weeks in as the dismal reality of job layoffs and debt problems really sink in. He thinks it's going to go into a long, excruciating slow recovery that may stretch over years. I think it's got another big sharp leg down of around 20% to 25%.

Either way, we both agree that big pharma has taken it on the chin in the last year, and is likely to do well in the eventual recovery. Meanwhile, many of these companies are paying dividends of around 4%. That beats the hell out of bonds while you patiently wait for a recovery.

One of the stocks he likes is LLY. I'm not a gung-ho about that particular stock, but that's beside the point for this exercise.

What I want to demonstrate, is that a careful application of options will give you a far better risk reward relationship than a pure stock play.

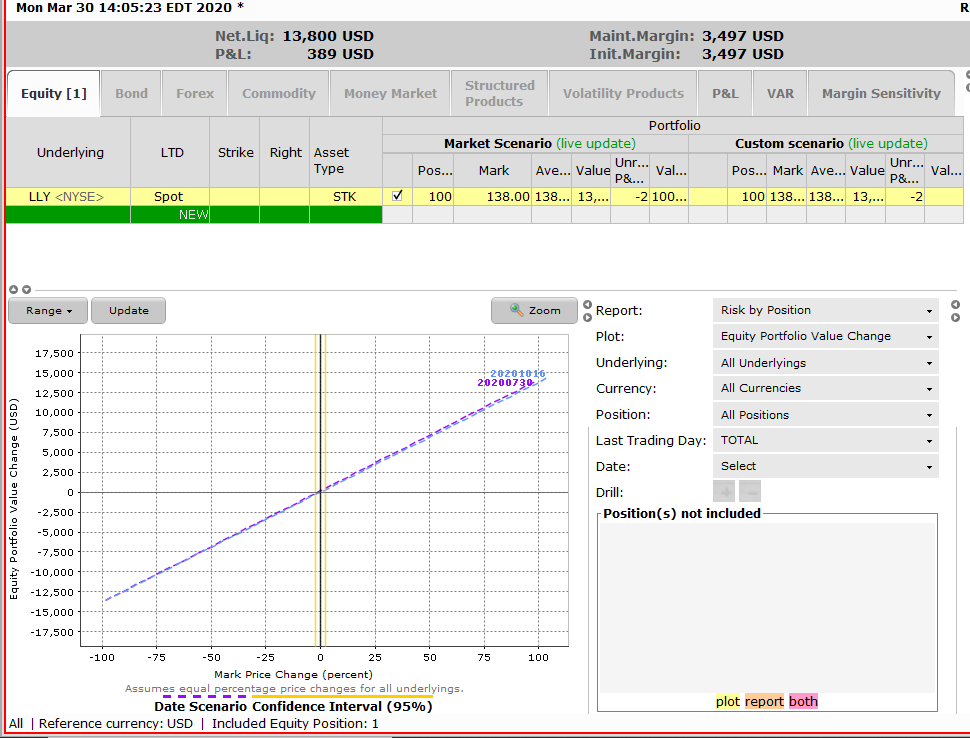

Let's say my friend was happy with the 2.3% return LLY pays around its current price of $139. He himself does not expect the stock to go down much more and he's betting it will be higher in 2 to 3 years. For the purpose of this example, let's say he buys 100 shares, for an outlay of $13,930, or a margin requirement of $3497. Here's the graph of his risk reward profile.

Click to view large image

Now fast forward 9 months. Say he's right and LLY is 10% higher. If he were to liquidate his positions, he'd have a gain of $1390, plus around $240 in dividends, for a total gain of $1630, or an annualized return of 15.61%. If you view it as a percentage of margin required, that's even more, 62.20%.

Conversely, if he's wrong and the stock moves down 10% (less likely, he thinks but definitely possible), he's got a mark to market loss of $1390 less the dividends, so $1150 overall, or 11% annualized in a cash account, or 52.9% annualized based on required margin.

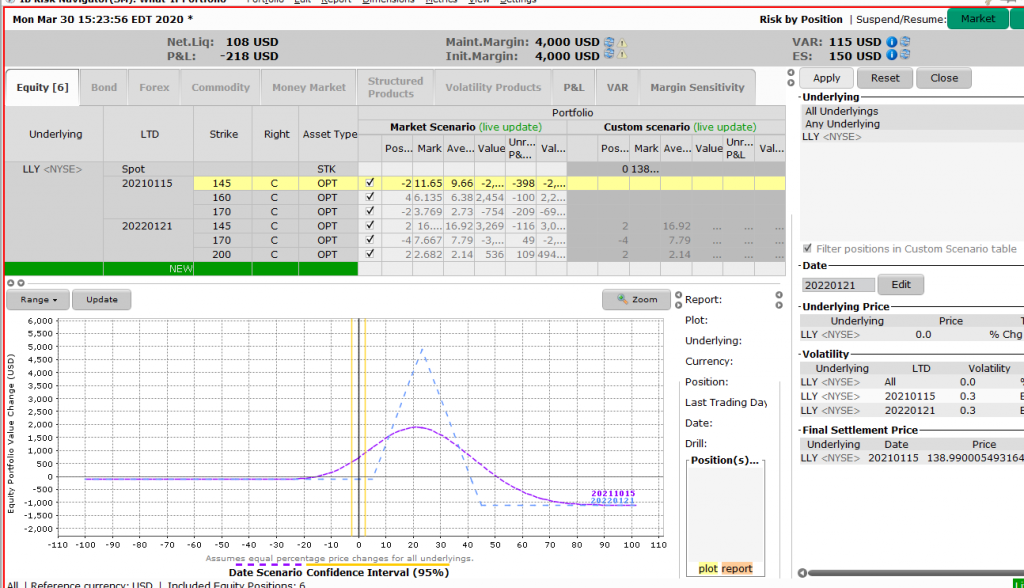

Compare that to a sophisticated calendar play shown below (consisting of selling a lopsisded butterfly expiring in October 2021, and buying a covering lopsided butterfly expiring in January 2022.

As shown in the graph, although this only requires a $95 outlay, it still requires a margin balance of $4000, similar to the stock only play. In other words, the investor has to maintain at least $4000 in the account, and amount which will not increase over the life of the option trade.

Fast forward 9 months, when the inner options expire, and we would liquidate all positions. On a 10% increase in the stock price, and even using the less favorable assumption that volatility decreases, he would close the trade for a gain of $2000. That's an annualized gains of 66.60% of margin, about 5% better than a stock only play.

Where the play really shines though, is if LLY slumps down. At any price, the maximum loss is only $108, or 0.36% annualized. Given the huge uncertainty in these markets, and the real potential of unanticipated medical or financial events sending markets careening lower, that limited downside risk will feel like manna from heaven.

If stocks move up 20% or down 20%, the option play advantage is even more crass. The only time the stock play is better, is if stocks rally strongly. At around 25%, the stock play starts being more attractive, and it becomes much more attractive starting at a 50% rally, as the option play loses a total of $1108 while the stock position has gained 50%.

But given this investors assumptions, of a stock that will trend higher but with great pains, and may even take a downturn, the option play shown here is clearly the more attractive position. Yes, it's complex. If it were not complex, everyone would be doing it and guess what: it would not be as profitable, because the options prices would be different.

Remember, options trading is complicated. Be sure to read our disclaimer. Consult with a professional before attempting such a trade, or your portfolio will suffer.