IWM – 03 Aug and 4 Aug Rolls

I got a bit behind in my postings so I will report the last 2 days of trading here.

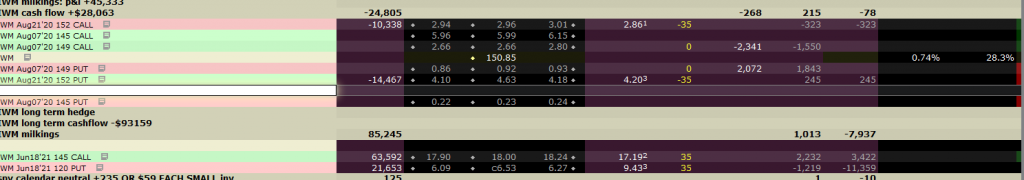

On the morning of the 4th IWM was threatening to breach its high at 149.60. so we closed our 145 strike straddle and shorted a 149 strike straddle. We lost $1.75 per share on the Call side, and gains $1.57 on the put side, for a net loss of #0.23 after fees.

Since we kept the dates at the shortest time interval, expiring on the 7th, we took a cash flow hit of $2.16 per share, or $7557 for our 35 contracts. This brought our cash flow down to $16,405 overall, or $4.68 per share.

Altogether we have milked $13.03 per share from an original investment of $26.61 made a little over 2 months ago.

size: 35 contracts

Long Term Hedge: $93,159 or $26.61 per share

Cash Flow to Date: $16,405 or $4.68 per share

P&L to date : $45,601 or $13.03 per share

Today, the next day, IWM breached the recent high for a second time. My technical analysis suggests it is likely to move up into the 150.50 to 151 area by the end of this week. So we rolled out our last straddle at 149 to replace it with a 151 straddle. In this case, I chose to move the date of the call back to Aug 14 to bring in more cash flow. So this improved our cash flow by $3.33 per share

This was a small loss of $268 on 35 contracts or about $0.07 per share.

size: 35 contracts

Long Term Hedge: $93,159 or $26.61 per share

Cash Flow to Date: $28,063 or $8.02 per share

P&L to date : $45,333 or $12.95 per share

Overall this strategy is performing extremely well. In the picture below, you see that we could close our long positions for a loss of $7937 on 35 contracts. Subtracting that from our gains yields a gain of $37,396 or 40% of our basis investment in just a few months of milking our cow.

Of course we will not close these positions but rather will continue to milk it for another 9 and 1/2 months.