SPY 05 AUG Rolls

Ok, this morning SPY had gapped up to 332, a hair length away from its all time high. I thought this was likely to happen, but I had still hedged out the risk of a big downside move, while sacrificing upside gains, because I was "unbalanced" in my sold option positions, being short puts but not calls. I described this in yesterday's post.

So of course my short stock position was losing money, and I quickly closed it, taking the expected loss. But my sold put was up by a bit more than that.

I wanted to center a new straddle on $332, so I bought back the 330 put, and sold a put expiring even earlier, on AUG 5. This gave me about a extra 10 cents of theta over the AUG 7 puts, too tempting to forego. Then I sold a $332 call. In this case the AUG 7 was more compelling.

Closing the puts at a gain then subtracting the loss on the short stock yielded a small net gain of $226 on 16 positions, or only $0.14 per share. That's not much, but I'm happy for the gain when I might have faced a $2000-$3000 loss if SPY had dropped.

Because I brought my time forward, I sacrificed cash flow, on my rolled put, but by selling a new call I brought in more than I took out, even after netting out the stock sales.

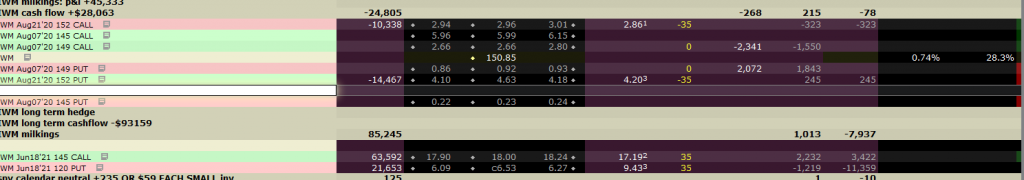

size: 16 contracts

basis $48,535 or $28.56 / share

cash flow $12,945 or $8.09 / share

p&l $9,971 or $6.23 /share

My long term options are profitable by $2029, but I will not close them out, nor roll them. I'm often asked why. I would only do so if I were very bearish on the market. I'm not. I think anything can happen. Rolling long term LEAPS usually incurs quite a bit of slippage as the bid/ask spreads are much larger. I'm content to give back some of these gains if stocks move lower, knowing I will sell a lot of short term premium to more than make up for it.