BAC – roll 24 July

BAC moved down with broader market, almost exactly moving to mid-point of our straddle. Compared July 24 to July 31 options theta, and these

were about the same. In other words the time erosion is almost identical. Since these must be closed by end of day, it made sense to do it immediately when we can place limit orders to get the best fills.

Sold the CALLS for a credit of $0.36 per share. Tried to sell the PUTS for $0.38 but only got filled at $0.37 after about a 15 minute wait. Total profit on closed positions was $49.20 per contract, or $4.92 per share.

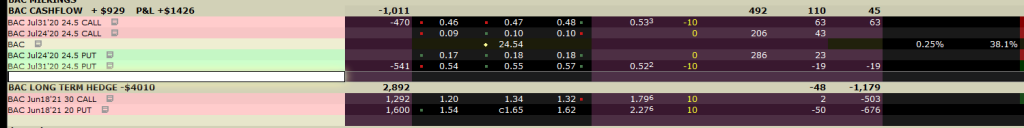

This boosts our earnings to $1426 from $934 on 10 contracts we trade, or $1.42 per share. Our cash flow increased by $25 after commissions.

size: 10 contracts

Long Term Hedge: $4010.00 or $401.00 per contract

Cash Flow to Date: $ 929.00 or $92.90 per contract

P&L to date : $1426.00 or $142.60 per contract