[print-me target="#post-%ID%"]

August 9 - Year of the Coronavirus

In this year of the Coronavirus, it's raining Dollars, and Euros and Yen. Reacting to the threat of the Corona Virus to global economies, the Federal Reserve, the European Central Bank and the central banks of Japan and China have unleashed an avalanche of money onto the world. The US alone has printed over $3 trillion this year, and is getting set to fund Congress' wish for another round as federal unemployment benefits have dried up this past July. This is around 20% of US total GDP and is a historically unprecedented outlay of deficit financing.

Normally, you'd fear inflation. But given very low consumption patterns of home-bound Americans, fearful of catching the deadly virus, the velocity of money is at a historic low. So the money printing has not created a big jump in consumer spending and huge inflation. .... Yet.

But the inflationary pressures are there, and the increased supply of money that does not boost the demand for consumer products and services inevitably finds its way to other areas of the economy. It has already boosted the values of real goods, be they stocks, real estate or gold.

This process is just getting started.

Do you really think the Fed is willing (or able) to suck out all that new liquidity once the crisis passes, once businesses recover and consumer patterns return to normal? OK, then you should not invest in Gold, or real estate or stocks.

But the last time I looked, politicians of every stripe in this country want to get elected, so they have a natural, self-serving propensity to give the public what it wants, not what the public needs.So I don't think we'll see the big increase in interest rates, to lower business and consumer spending. A big rise in taxes? Nah, not even if Democrats take back the reins of power.

So that spells trouble when "normality" returns, and with it the normal velocity of money. It will mean boatloads of money chasing more or less the same level of goods and services. Which means INFLATION, and yes, the caps I placed on that word are not an error...

So investors will continue to seek assets that are immune of benefit from inflation. Gold is a natural winner in this scenario, as is real estate, and unexpectedly - asset classes like Bitcoin that were traditionally thought too risk-prone and unpredictable.

So in this trade I will focus on Gold.

Here's what our long term charts show:

click to enlarge

Though not shown on this chart, a tracing of relative strength indicators for a period of 50 or 100 weeks would show positive convergence of price and rsi, with both making higher highs. The wave patterns have been exceeding their expected fibonacci extensions, another bullish sign. We expect GLD to more than double in value over the next two to three years.

In the very near term, we should see a retracement down to the floors established at around $196. This should be fairly rapid, taking place over a period of 2 to 3 weeks, at most. This is based on historical drops and retracements, such as that which occurred in mid-March. (We'll be doing a separate bearish trade on that, but that's the scope for another article.)

An analysis of time cycles, tracing the troughs of the cycles from low pivots to low pivots, suggests that GLD will reach its 3rd Elliott wave high around $233 around mid to late November. Probably not coincidentally, this happens to converge with the upcoming national elections. No doubt that will be fraught with a high degree of uncertainty, which in the past has led to high prices in Gold.

Does this have to happen by then? Of course not. These cycles are NOT written in stone. They are more voodoo than science, but they have a funny way of playing out more often than not.

With options plays, the more you can nail the time frame down, the more money you can make. If you play it too short, you'll lose money even if you got the direction right. If you stretch your options out in time way past the events, you may still make money but you're leaving a lot of money on the table.

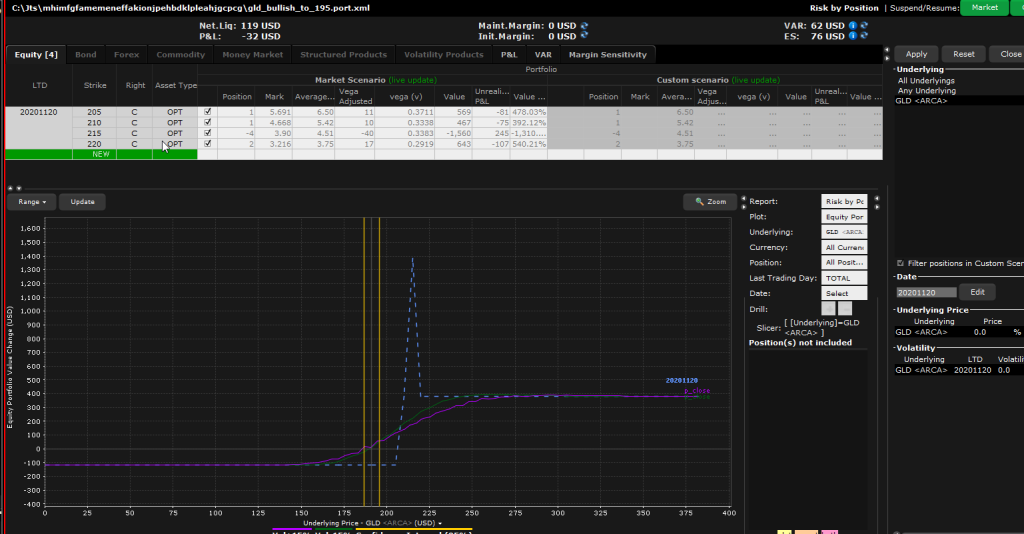

So I've set up multi-legged options strategy that bets that GLD will reach its expected high of $233 by November 20. That gives us a little fudge room beyond the elections. If it takes longer to move, the position will still make money - just less. And if GLD explodes beyond what I think is possible by November, the trade still is very rewarding.

A simple butterfly, expiring on November 20 and centered on $215 with the wings $5 away would give us a 1 to 14 risk/reward ratio, enough to make one salivate.... But that would lose money if GLD ended up just short or a bit higher than we had targeted. So I've wrapped that in a broken wing butterfly trade, whose outer wings are $10 away and $5 away from the fulcrum.

click to enlarge

The result, you see, in all its resplendent "butterfly" glory. For each contract, we risk $119. We'll lose that if GLD never rises from today's level by mid-November. But if we nail the target price AND the time, woooowwwww. We could make anywhere from 8 to 14 times our wager. And if GLD is friskier than we thought, moving beyond $233 by November 20, we'll still make around 3 times our money.

Want to understand this trade even better, and see how I came up with it? Then check out our recent Youtube video which zooms in on this trade and shows you how to put it on.

Make sure you read our disclosure. We believe anything you can do with stocks you can do even better with options. But options trading is complicated, and can be risky if you don't know the intricacies.

Disclosure: Options investing is inherently risky. This is not a solicitation to buy or sell. Please read our full disclosure on this site.

Happy Trading!

[print-me target="#post-%ID%"]