Cloud Computing Brews The Perfect Storm at Rackspace Hosting

[print-me target="#post-%ID%"]

Rackspace Hosting faces the perfect storm. This fast-growing cloud-computer technology stock just got hit by a double whammy. It has disappointed the market with less than stellar results in its most recent earnings report.

And its lost its CEO.

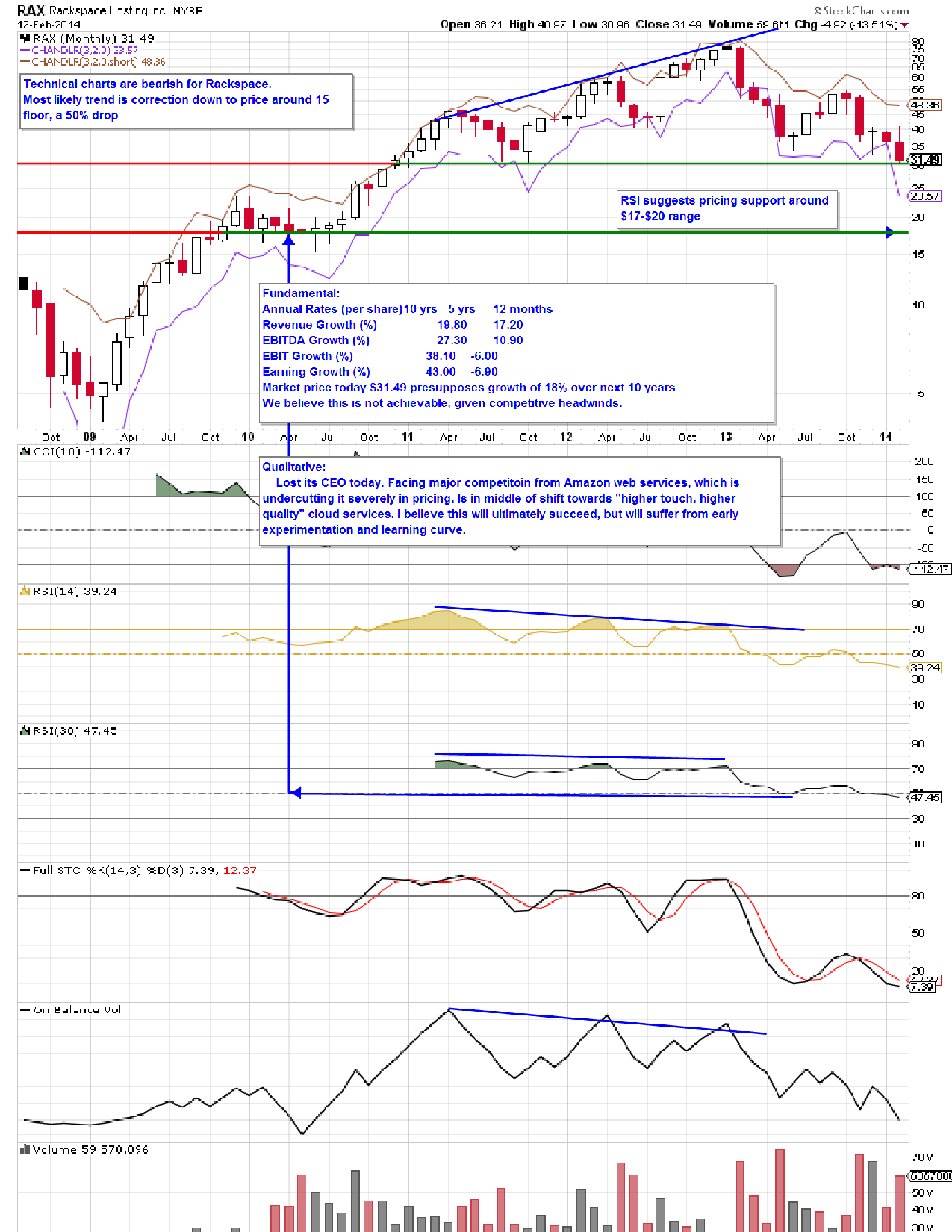

Management has admitted to difficulties competing with the bare-bones profit model of its chief competitor, Amazon Web Services, who is dead set on owning this industry sector. RAX management has already undertaken steps to cater to a more service-oriented, upscale corporate clientele, but this will probably be a bit of a learning curve, and growth and earnings may both suffer a bit along the way. At current market prices, around $31.50 at time of writing, a Reverse Cash Flow analysis reveals that the market projects an 18% growth rate over the next 10 years. I think that is too ambitious, given the competition.

To add insult to injury, RAX faces management upheaval, with its CEO Lanham Napier announced his retirement today, and no planned successor is on the horizon.

The market should punish this high-flier severely. It has already lost 33% of its value in just two days. But the damage may not be done. A glance at technical charts reveals that after a possible bounce at current prices, the stock may move much lower, possibly to $15, with a pause along the way at the $25 support level.

This presents the following opportunity for aggressive investors, based on a a bearish options bet. It will lose a limited amount of money if we are wrong, and could hit big if the stock drops.

- Probability : 70% (my subjective guesstimate)

- Risk : Reward : around 1 to 5

- Duration: 7 day trade

- Minimum Investment:$433

- Maximum Investment: none

[membership level="0"]

[/membership]

[membership level="1,2,3"]

I believe that Raxspace's drop in value, if it happens will be sharp and dramatic, not slow and lingering. So I am not too concerned about the passage of time. Secondly I will use technical floors to my advantage to prevent establishing the play at all unless it has just broken through resistance. I make this entire options play contingent on the stock dropping below $31.00.

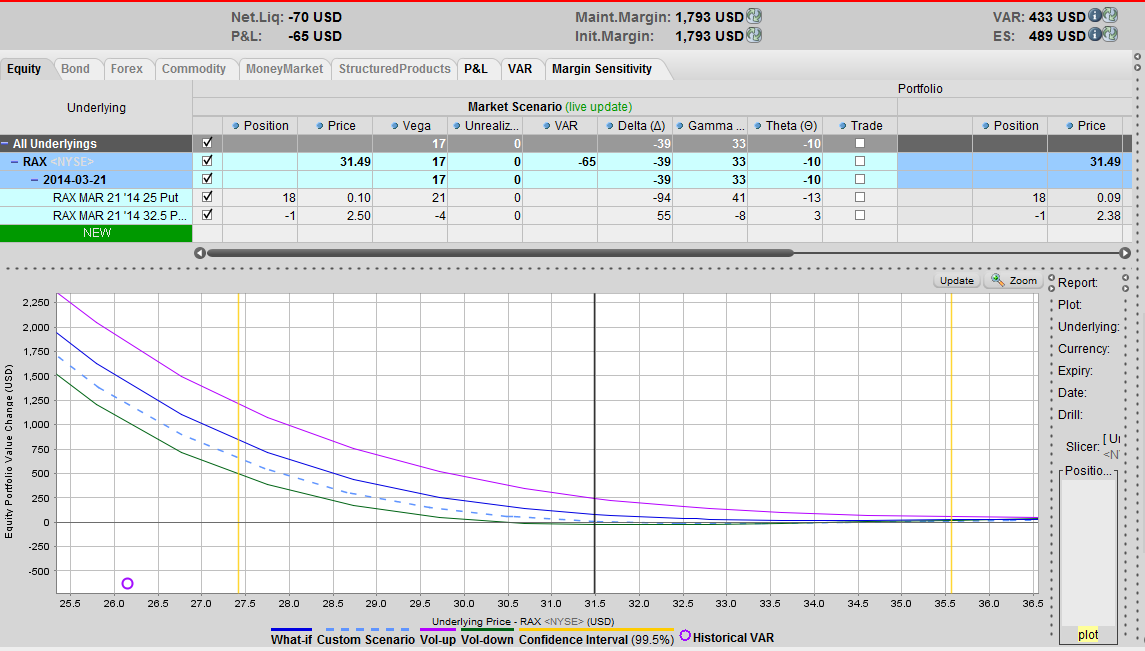

Since I cannot foresee the exact values of the options if that were to happen, I put a limit order of $0.20 per option position, although in many cases this plays will actually result in a net credit, as more money is collected from selling the just-in-the-money put than is spent on the 18 baskets of deep out-of-the-money puts.

sell 1 RAX Mar21'14 32.50 PUT collect $2.40

buy 18 RAX Mar21'14 25.00 PUT spend $2.40-$2.60

net cost : (-0.10 to + 0.20 ) per share x 100 shares = $-100 to $200 total

I always like to start my options bets with a worse case scenario. This bet will suffer maximum losses if the volatility drops very sharply below its long term average of around 40%, at which it has currently stabilized after its recent earnings volatility collapse. Secondly it will suffer from the passage of time.

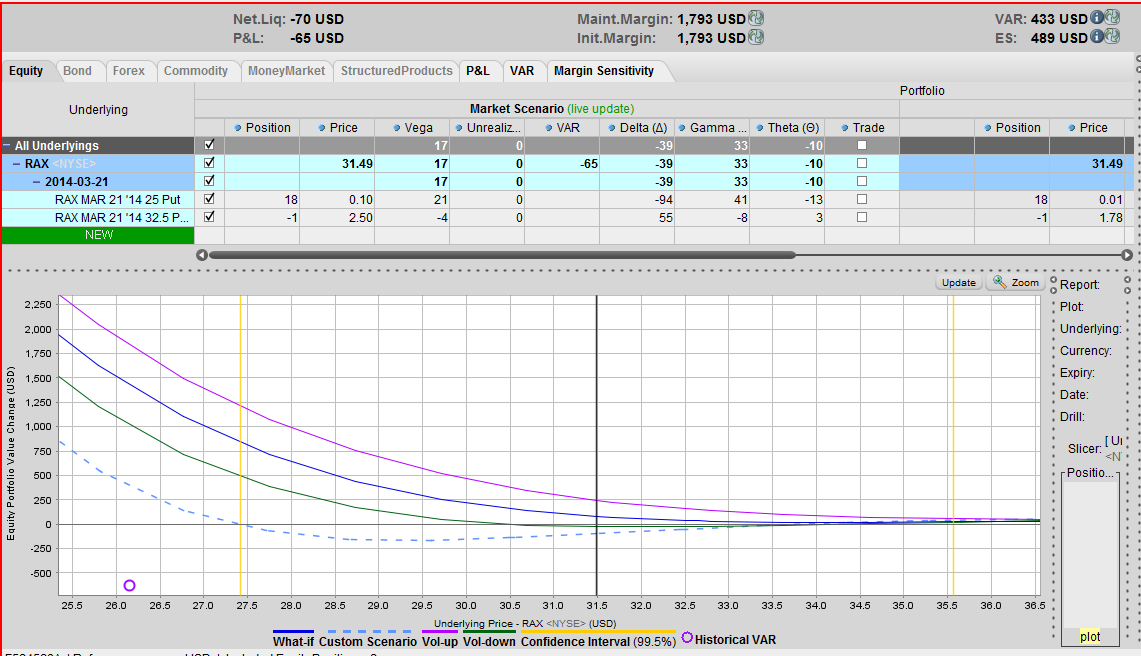

The graph below shows the potential loss (dotted line) if volatility drops a lot (20 percent) and two weeks times elapses. As you see a potential loss of up to $125 is likely in that scenario.

By only entering into the position after the stock dips below an important floor, I am decreasing the effect of the passage of time. That floor, once penetrated, usually becomes a ceiling, preventing the stock from moving higher. At that point, I believe the stock will drop precipitously, so I'm not too concerned about time erosion to the value of my positions.

This position would suffer even more from a drop in volatility. I would benefit one time from my short put at $32.50 (able to buy back the obligation for cheaper than I paid for it), but would lose 18 times on my long strikes at $25. This is the second reason I only go into this position if a floor is breached.

Most of the time, price drops lead to an increase in volatility, not a decrease. It's not impossible for volatility to decrease on a price drop, but its fairly unlikely. More common is a sharp increase in volatility. So the scenario you see above, with losses around $125, is not very likely.

In this particular case, I expect a fairly stable to slightly increasing volatility if the stock drops below $31. I believe most of the increased volatility has already been baked into this price. Still, here's what a 20% increase in volatility would likely entail: at a price drop to $27.50 we would be looking at profits of around $600.

Of course, the slower the drop in price, the more time erosion depresses the value of my numerous long put positions. So I would be looking to exit this position fairly quickly, within about 1 week to 10 days after establishing it.

Maximum risk on this trade is for the stock to drop to very low price higher than $26, yet for volatility also to drop by 95%. In that case, the position could lose around $550. How likely is that? Almost nil.

The maximum possible gain would occur if the stock went to zero. In that case the net value of the position would be around $42750. That is equally unlikely.

So when weighing probable maximum losses versus probably maximum gains , the losses that appear possible are around $125 and the gains are around $600. A faster drop could produce gains of as high as $1200 at $27.50 So the risk / reward hovers between 1: 4 and 1:10.

Stay posted on this trade, and in about two weeks we'll see how we did. May your trading be well rewarded.

[/membership]

[print-me target="#post-%ID%"]