Benefit From the Acrimony – A Volatility Options Play

Ok, here we go for another round of Russian roulette in Congress, with the congressional budget talks at stake.

As MSNBC recently reported :

Without an agreement before October 1, a huge array of government services would cease—from processing veterans benefits to cleaning up toxic waste—and all but the most vital government personnel would stop coming to work.

With no clear path toward a compromise between Democrats and Republicans, the question isn’t whether we’re going to have a government shutdown, but how we’re going to manage to avoid one.

While the deadline for resolution of this impasse is looming - September 30 - prospects for a compromise solution are looking increasingly unlikely. Whether Congress allows the deadline to pass without a new budget - or politicians allow for a solution at the last minute, either way, I think we're in for a sharp rise in uncertainty. I expect this will be reflected in options prices for the VIX volatility index.

Take a look at the VIX's levels over last few years.

The VIX is currently still trading at a level - that in my opinion is unnaturally low. I personally think the politicians will work something out in an 11th - hour solution, but not before their backs are put to the wall. So, just as in the past, I expect a short term jump in volatility.

There is a ceiling around the 26-27 level, which I do not think we will breach. If politicians cannot come to a compromise and increase the macroeconomic risks in the debt-default talks of December, that might be something likely to send volatility to sky high levels and test the next ceiling at 48.

On the low side, I do not think the VIX will go much below its current low around 13.50. For it to drop back down to the 2007 lows around 11 I think we would need a grand bargain among politicians concerning government spending, entitlements and the long term debt. Unfortunately, I do not see that anywhere on the horizon.

So while we are likely to see a roller coaster month for stocks, here's at least one way to benefit:

[membership level="0"]

Register for a FREE 60 day trial today. There is no initial cost to try out the service, so join today!

Register

[/membership]

[membership level="1,2,3"]

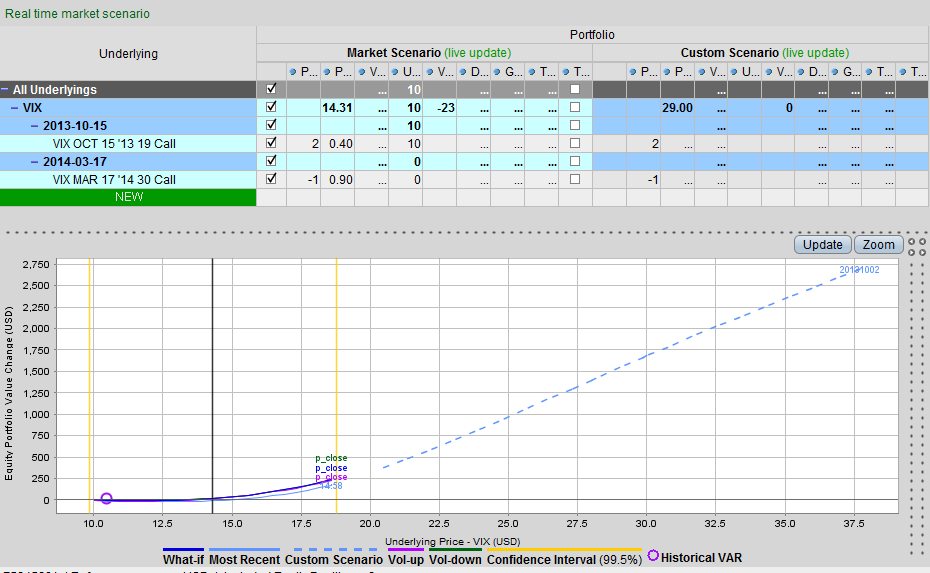

- Sell 1 March 2014 30 call. Collect 0.90 cents x 100 shares or $90

- Buy 2 October 2013 19 call. Cost 0.40 x 200 shares or $80

- Net credit :$10 (minus any brokerage fees)

What's the upside? Well, if volatility jumps to levels around 25 - altogether possible - and even likely, this option play could make about $1000. If it goes up just a bit, even at less than 19, the play still makes money, as you can see on the graph. What if it moves beyond that? Well, let's not get greedy...

click to enlarge

The Downside

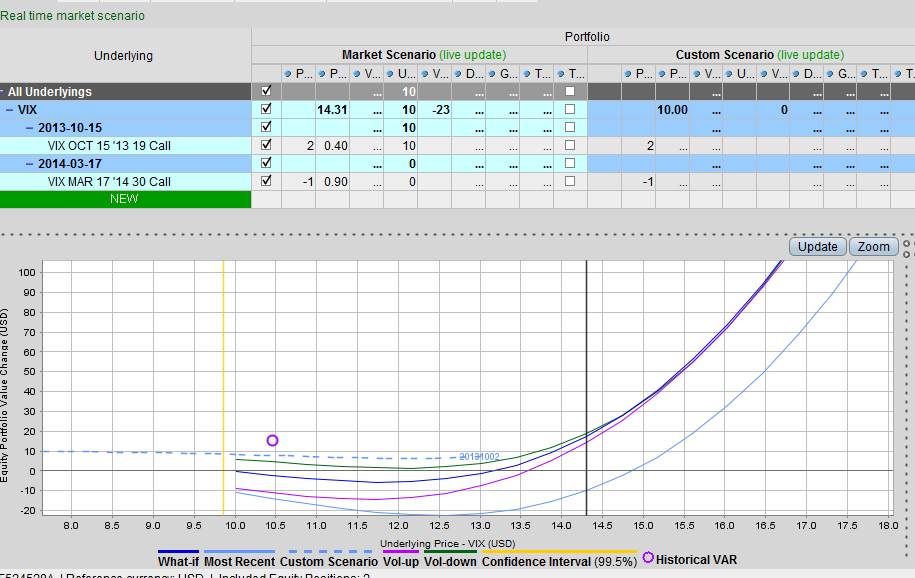

What if an unexpected deal miraculously emerges that please everyone, and uncertainty drops? , because we've sold a calendar diagonal spread, and are credited $10 (0.10 x 100) we'll be in good shape. We get to keep that money. However, due to the small difference in bid-ask spreads in closing out our March position (about 10%) , a small loss of around $20-30 is still likely in this scenario.

click to enlarge

The Risk

The risk in this trade comes at expiration of the front month option. If you wait too long on this trade and let the October option and the VIX subsequently spikes up to levels above 30, your losses would mount by 100 x $1 for each 1 rise in the index.

Which is not a problem for us: we intend to exit this trade well before the October option expires on the 20th of October.

[/membership]

[print-me target="#post-%ID%"]

I’ve done this trade, and am up about $300. Should I still hold on? I know the decision in Congress is on Monday.Won’t this cause volatility to fall?

Yes, I would hold on until around 3 pm. At that point, you may want to close out positions. I will probably take profits, but then buy a further out of the money call costing about half the profits I’ve made. Congress may not reach an agreement, and in that case volatility could climb even higher.

Or you may choose to do nothing yet. Remember your downside risk on this trade is limited until the option expiration date approaches expiration. Volatility may stay very high until Congress finishes debating the debt limit issue in late October.

Just closed out this calendar spread at a profit of $554 on my 25 contracts, ( $22 per contract). I immediately reinvested 1/2 earnings in single out of the money 28 call. This locks in a nice profit, but still permits upside of up to $125 ($3000 on my 25 contracts) if Congress does not settle this by midnight today.

click to enlarge

Right now there’s a kind of civil war going on among the ranks of the Republican party. A small faction, representing the Tea Party, feel it is imperative to make a stand on the ObamaCare issue before the exchanges roll out. They are willing to face a government shutdown to do so, feeling the stakes are worth it. A larger set of Republicans – while disliking ObamaCare – feel it is suicidal to shut down the government over the issue of the rollout. They prefer to let Obamacare roll out, at which time they are convinced it will fail over time and make voters more and more unhappy. This would then theoretically permit a Republican win in the Senate in the next elections and allow them then to reshape the country’s direction.

Who will win this battle of wills? I think it’s still a tossup. So I’m banking half of my profits on the recent trade. A $268 gain on what I perceived as a maximum risk of $150 in just two days is a great return.

But there’s still a good chance things will not settle out by midnight tonight. If this issue is allowed to fester another 24 to 48 hours, I believe the VIX could easily reach its next ceiling at 22, and possible even move higher.

So I now invest half of my earnings in a simple out of the money call. I purchased some 28 calls at 10 cents, and got an even better deal on a smaller number of 27 OCT call also at 10 cents. If Congress settles this by tomorrow I doubt I’ll even get one fourth of that money back. But if not, and volatility rises to just 22, I calculate I’ll make about 15 times what I risk. Here’s the graph:

click to enlarge

Status Friday Oct 4, close of day

VIX briefly spurted up to 18.75 before retreating back down to 16.74.

Because I was scheduled to be out of the office on Monday morning and unable to follow this situation closely, I had placed a stop loss (retain profit) on this trade which triggered for me at an average price of 23 cents. So my original bet yielded a total gain of $22 per share, or $1650 for all my positions. This is about 3 times more than my maximum possible loss when I launched this trade.

On Tuesday, when I can pay attention to the market again, if the VIX is still trading below 20 I will buy more calls. This time I’ll want something that expires after the October 17 debt talk deadline.

The market has not yet dropped on these events, as the consensus seems to be that the politicians can not possibly be crazy enough to let events come to a head.

I think the politicians will finally compromise, but not until markets drop first. That’s what will pressure them to blink. This could send the VIX up much higher. Watch for my post on Tuesday or late Monday.