SPY Milking Our Cow on August 13 and 14

On Thursday, SPY started out the day on a moderate drop, so we immediately rolled our 338 straddle into a 335 straddle, at a tiny gain of $28 per straddle, or $0.28 cents per share. During the same day we bought and sold only the threatened call side for a $0.48 gain.

On Friday, SPY did not move much, but we rolled twice during the day to accomodate each $1.00 move. The reason for this is that on the last day of expiration there is a large reduction of theta loss in any strike but the strikes right at the money. So to maximize our option income, it is worth rolling frequently.

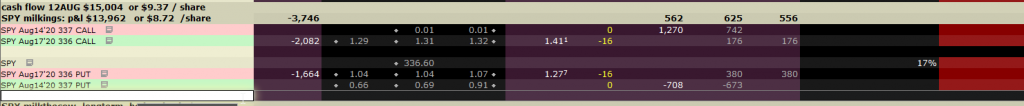

As you see below, we've ended the week in great shape, with another day of gains. Our long term leaps could be sold at a $5886 profit, and we've

realized $13,963 of gains. We've had this position on for 17 weeks. This come to a 41% return. Annualized, if this continues at this pace, this would produce $125%. Of course, we'll have to see how things develop.

size: 16 contracts

Launched April 4 2020

basis $48,535 or $28.56 / share

cash flow $15,043 or $9.40 / share

p&l $13,963 or $8.72 /share