SPY – 12 August Rolls

SPY continued to ride the Corona Express roller-coaster today, rising sharply after swooning 7 points in late trading yesterday. Looking

at the technicals, I was convinced SPY would rally to 334, but drop from there to around 332 by the end of the week, and possibly lower to $329.

Late on the 11th I believed the downturn was temporarily done and we were due for a dead-cat bounce up to 334. So I did not yet want to close my 337 deep-in-the-money put, hoping to buy it back cheaper as the price reached 334 again. But as the market was moving fast, I placed a buy order if SPY breached lower lows. That happened after hours, at a price of $4.12, resulting in a loss of $2.63 per share. I normally would have sold a 334 put at that time, to bring in additional premium. Oh well...

This morning, SPY had gapped up to 335, a little higher than I expected. Looking at the charts, I still expected it to hover around $334 for a day or so before dropping lower. So I collect my aug 12 337 calls to 334 bringing in $2.52 in premiums,

Of course, SPY did not care what I thought, and did its own thing. to my surprise, it reached all time highs at $337.47. So I had to roll with the punches, even though I'm still not convinced that we are not seeing a double top formation. I learned years ago to listen to what the market says, and not what I think it should do...

So I again rolled to the now higher centered point at $336. I could have centered at a strike of 337, but again, I felt that the runup was overdone, not being accompanied by any positive news on the political front regarding corona-support measures.

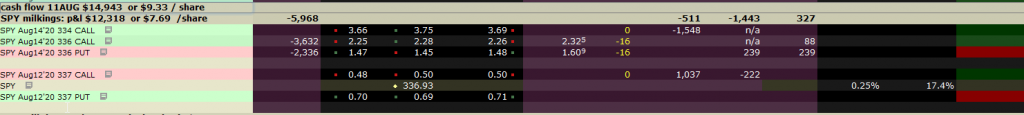

When the dust had settled at midday, I had a small loss overall of $511 or $3.19 per share, with a cash flow reduction of $2349 or $1.47 per share.

size: 16 contracts

basis $48,535 or $28.56 / share

cash flow $14,943 or $9.33 / share

p&l $12,318 or $7.69 /share