IWM – Aug 5 Rolls

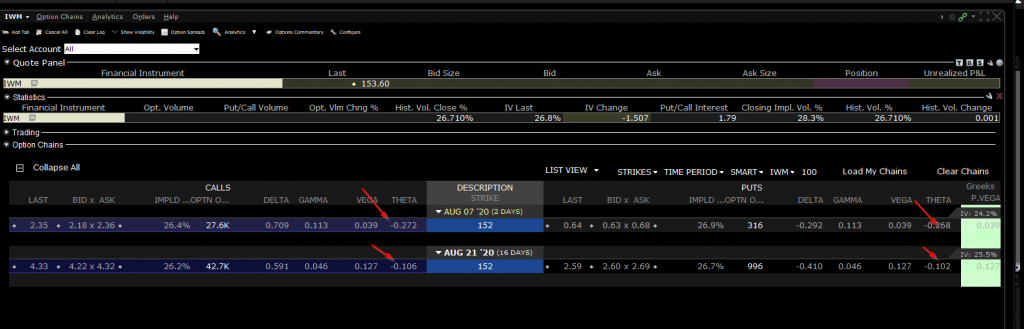

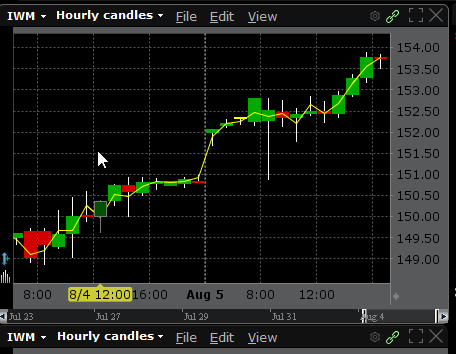

Contrarily to SPY, IWM had not moved up quite as much, and looked like it might correct back towards our 152 straddle center. So I chose not to change the center point. However, the position was profitable. Upon examining the theta decays on the Aug 21 that I had been holding versus the new Aug 7 straddle and the condition of my cash flow - quite positive , it made sense to me to sacrifice cash flow and gain more time decay.

In the graph below, the red arrows show you the comparative Theta values. The shorter term options lose around 0.33 theta more each day or around $0.33 cents per share.

size: 35 contracts

Long Term Hedge: $93,159 or $26.61 per share

Cash Flow to Date: $13,675 or $3.90 per share

P&L to date : $46,812 or $13.37 per share