How To Play Uncertainty to Goose Your Wallet

As I write this, the corona virus has swept the entire planet, leaving death and economic destruction in its wake.

Click image to view in larger format

Think its all over? Well, your a lot braver than I am, and in a few weeks you'll be a good bit poorer, I fear. I expect a 32% corrective bounce up, than another big leg down, leaving us with a total 50% correction. If you want to start bottom fishing then, you've got my blessing.

But there is one way to play this crisis. "Fortunes are made when blood is in the streets", goes the saying. Well unfortunately, that's the situation now, and I fear it will get much worse before it improves.

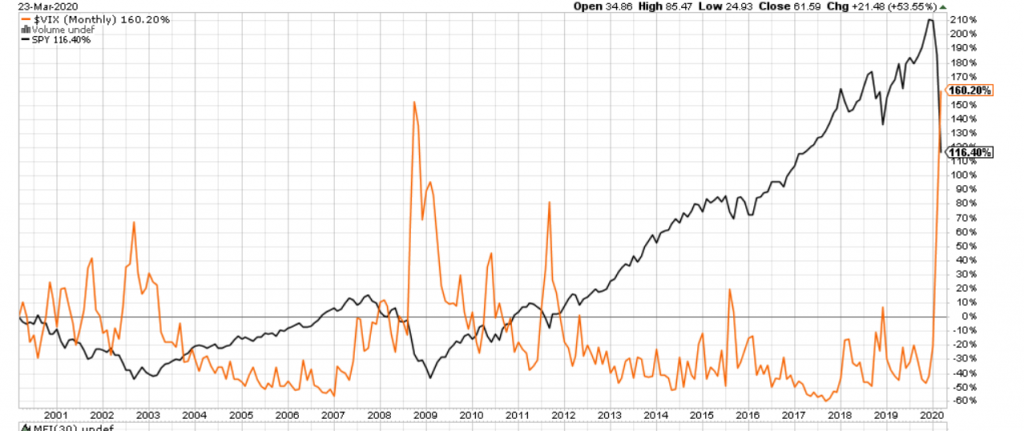

Check out the first graph. It shows you that today's levels of uncertainty (red line VIX) spiked higher than at any time in the last 20 years, even more than in 2008 when the financial system was teetering. So it could well be that volatility, reflected in the VIX index, is close to its current peak.

Click image to view in larger format

It's pretty obvious that uncertainty will drop if the market recovers. That's a no-brainer. But I don't expect the market to stop dropping. In fact I expect another huge drop. I could short the market with options, which I've done and described previously, a trade which has rewarded us handsomely thus far.

But there's a safer trade, one that makes money regardless of stocks going higher or much lower. A strange thing happens in market crashes: people get used to the pain. Each and every subsequent drop, while just as harmful to the economy and to investors' portfolios, hurts subjectively just a little bit less, and shocks us less and less as investors.

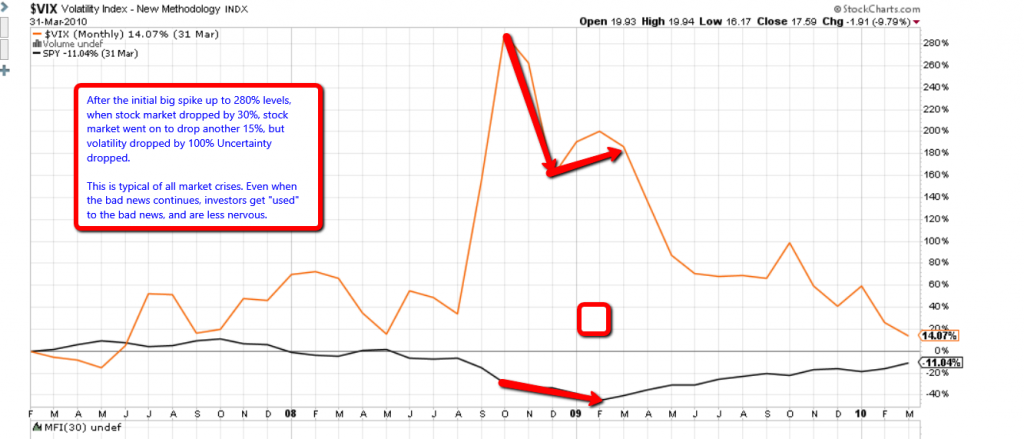

That's why you got the following behaviour in 2008:

Click image to view in larger format

Notice how volatility skyrocketed on the first big drop in SPY (S&P ETF)? Volatility rose 280% on a 23% drop in stocks. But what happened afterwards? Stocks continued there drop, losing another 7-10%. But instead of risking, volatility dropped by almost 100%!

If stocks had risen, volatility would have dropped even more! The lesson here, is if you can short volatility without betting the ranch, you've got a dream stock play. That's just what we'll do.

Our wager? That between now and January 2021, the stock market is likely to be much lower. (I actually expect the big drop by September-October, just in time to mess up the elections, but that not germane here.) But we'll have gotten used to the dismal state of affairs, so volatilty will drop down to the 20's or 20's. And if things improve and God-willing we get a handle on this nasty disease, all the better. Volatility will drop even more.

I don't expect it to reach the artificially low levels of 10 or 12 which we had previously, a gift from the free spending FED from its unlimited (imaginary ? ) reserves of money fresh off the printing press. My best guess is it will settle into the 30 to 40 range.

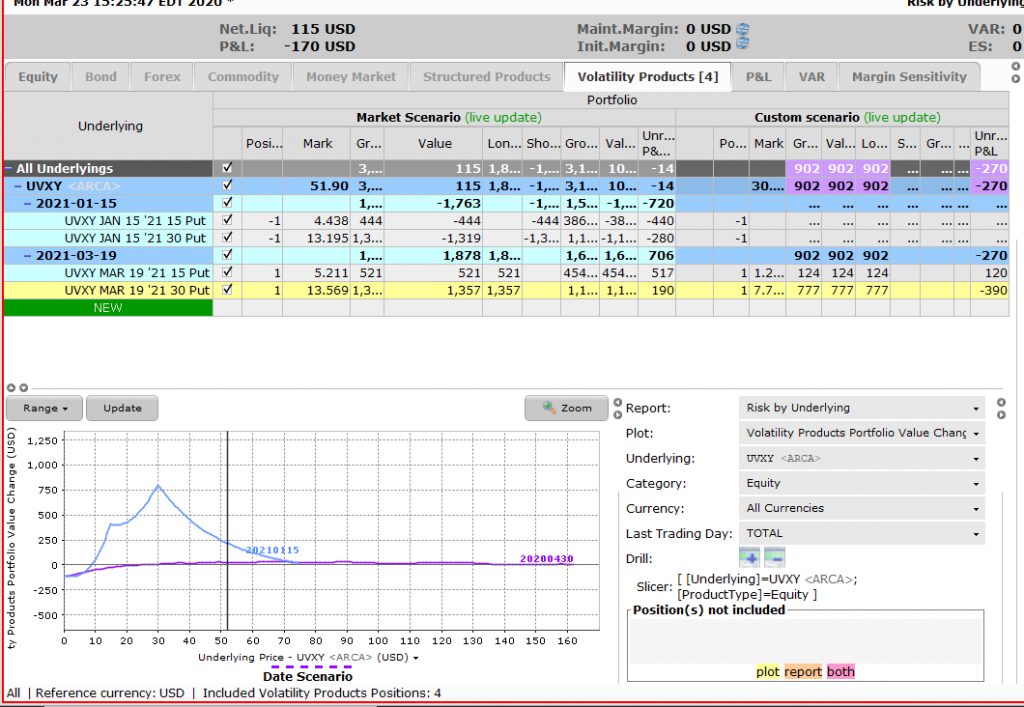

So I'll use a calendar spread, selling UVXY (a volatility driven ETF) put options that expire in January of 2021, and buying covering puts that expire a few months later.

Click image to view in larger format

For this play to lose money, volatility must remain higher than 70, or drop lower than 10 by January of next year. I cannot imagine either scenario occurring in 10 months time. If they do occur, I lose the entire amount spent on the position. For 1 set of each calendar option, this is around $115. The reward is maximized if volatility ends at around 30 points, in which case the position can be closed at a profit of around $750. If it drops back down as low as $20, the gains are around $500, or 4 times what I've spent.

Remember, options trading can be risky. Be sure to consult our disclaimer page.