FASTENAL (FAST)

This is a position origally entered into as a calendar spread after earnings

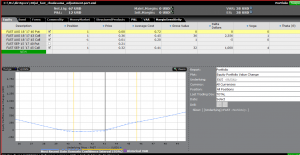

As you can see, I expected to make money anywhere between 37.50 and 47.50, with a 95% statistical probability of being the price range.

Unfortunately, volatility dropped far beyong what I expected, diminishing the values of my still active long calls and puts. Rather than close them at a small loss, I decided to adjust the trade, giving it a bullish bias.

The $37 profit I already booked is reflected in this graph by modifying the cost basis of the 45 calls we sold.

Here was my prognosis for the stock

So in my adjustment, I kept the long puts for safety until I saw a breakout or volume confirming my upside bias.I converted the long call into a ratio spread, buying 1x 18sep 43 call selling 2x my position of 45 calls, and buying 1x of SEP 45 calls. This is long delta, benefitting from a price rise, and will only slightly lose from the passage of time and expected decrease in volatility.

My maintenance margin, per position is zero dollars, requiring no extra outlay, and my maximum loss per position is $38. At the price I reasonable expect the stock to reach by the expiry of the near term options, I stand to make about $100/position. This is a risk reward of about 1:3.