Power Up Your Portfolio with A Quick QQQ Scalp

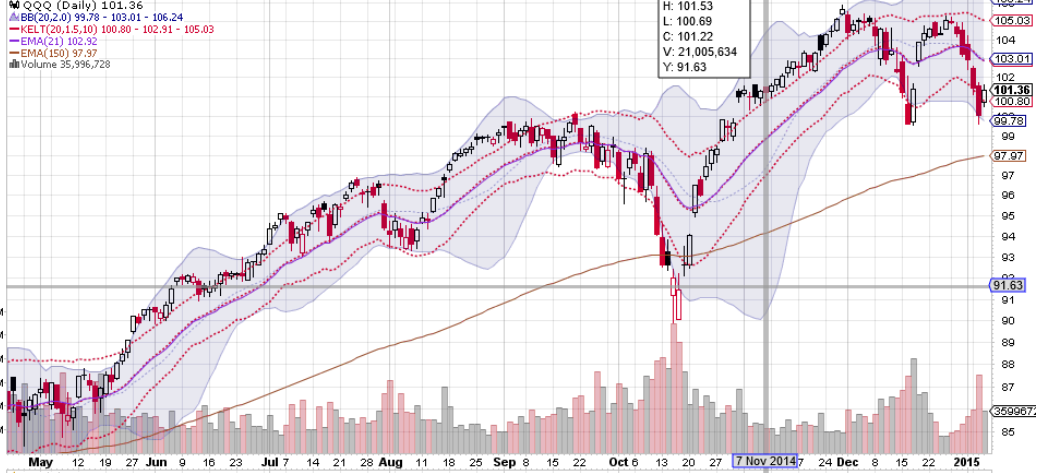

At market close the POWERSHARES ETF (QQQ) was trending in a narrow range, having found support and bounced off the 99.68 level. My prognosis is that we will see QQQ bounce up to test the resistance at $103, then from there a move down over the next week to prices below $99.

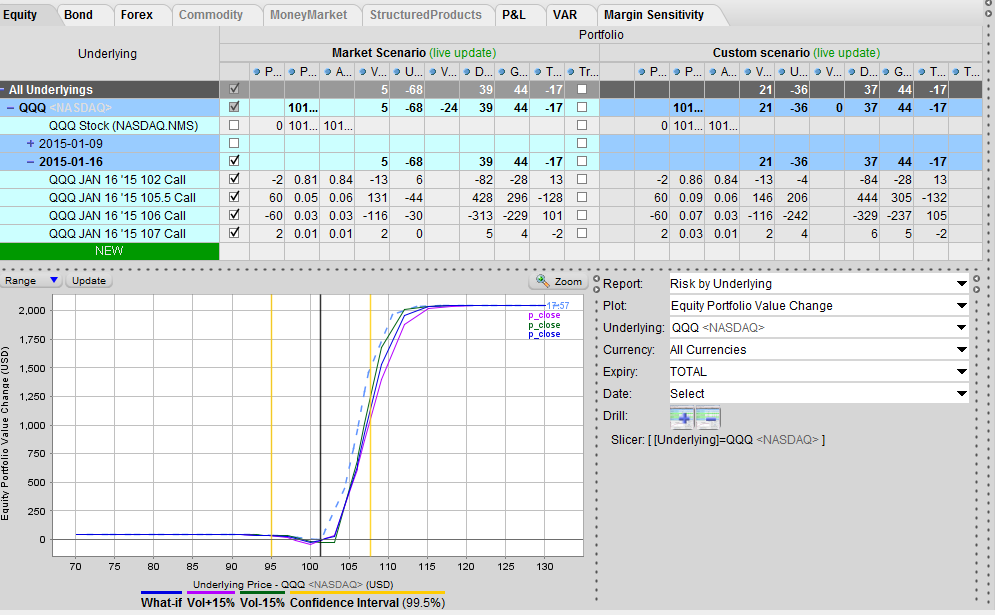

Here's a wonderful way to play that, using the banker's money to finance a credit spread. If it never happens, and the stock stays stagnant, there is only a miniscule loss of about $5, and at bigger drops there is even a small maximum gain of $40. For every position you commit to this trade, you must have $2000 in margin. You have about a 1% chance of losing $5 and and 95% chance of making between $1 and $500. Those are odds anyone would like.

- Probability of success : greater than 95%

- Risk : Reward : around 1 to 50

- Duration: 2 day trade

- Minimum Investment: -$40 (credit)

- Maximum Investment: none

- Margin Requirement: $2k per contract

- Maximum Probable Loss : $5

- Maximum Probable Gain : $250

- Maximum Possible Loss : $5

[membership level="0"]

The remainder of this posting is restricted to TradeJolt members only. Please login using the link below. If you are not a member yet, click below to sign up for our FREE 30 day trial membership.

[/membership]

[membership level="1,2,3"]

If you look at the risk spread below, pay attention to the dotted line. This is the effect of the trade position at close of day on the 9th of January. We essentially are going short (selling) a very wide just OUT OF THE MONEY call spread. This gives us an ample amount of money which we use to buy a greater number of further out of the money call spreads. Our maximum loss occurs if QQQ does not budge by Jan 9, but we stand to lose only $5. If QQQ moves up as anticipated to $103, we stand to make about $240. If QQQ moves up more, we should close out positions at $111, since the trade cannot make any more money than that, and you could free up the margin for another transaction.

This is the maximum time we will hold this trade, as thereafter the time erosion on our long OTM call spread begins to seriously impact our ability to make good money on the trade. If held beyond Jan 9, time erosion means a larger possible loss could be occurred, up to a maximum of about $600, with the closing price around $105. SO IT IS CRITICAL THAT YOU CLOSE OUT THE TRADE BY JAN 9, or face a larger possible loss, with a much higher probability. Before that time, your loss is miniscule, and your probability of obtaining a siginificant profit is commensurately high.

Hope you benefit from this trade. Stay posted for the results.

[/membership]

Disclosure: Options investing is inherently risky. This is not a solicitation to buy or sell. Please read our full disclosure on this site.

[print-me target="#post-%ID%"]

[print-me target="#post-%ID%"]