Electrify Yout Options Trading On First Solar Earnings

[print-me target="#post-%ID%"]

First Solar's (FSLR) upcoming earnings announcement presents us with a unique opportunity smart option traders won't want to miss. FSLR is scheduled to announce their quarterly results January 30 after hours.

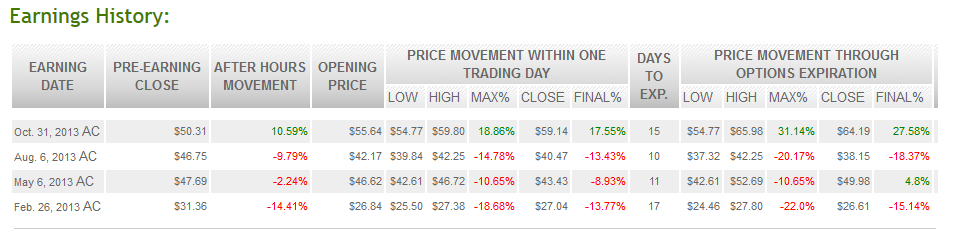

First Solar is one of those stocks that is the volatility traders' dream. Check out what has happened on past earnings reports in the table below.

Never has the stock moved less than 10% on the day following earnings, sometimes moving as much as 18%. This is a huge move for a NASDAQ stock enjoying such ample volume of trades to feature low bid/ask spreads and weekly options positions.

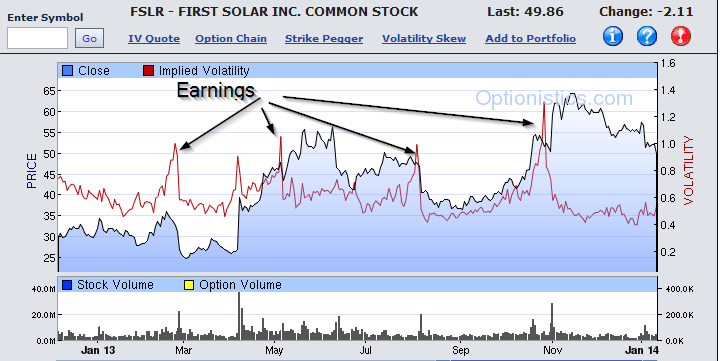

With such huge price movements not only possible, but even likely, it is not surprising to see that options volatility spikes about a 7 to 10 days before the earnings announcement, as long positions and short sellers scramble to insure themselves against adverse movements.

This is shown in the chart below, with the volatility increasing from 70% to 150% just prior to earnings.

Investors with a stake in FSLR want to buy the cheapest insurance possible. Those are represented by options contracts that expire the day after earnings, in this case on January 31. As I write this, the stock is trading at $51.20, and buying a collar - buying a 52 strike call and a 51 strike put - sets me back $3.71 per share or $371(plus trading fees) for 1 contract.

With FSLR usually moving at least 10% on option trades, speculative investors might want to just do that and wait out the earnings report. As long as the stock moves by more than $3.71 cents or 7 percent, they could make money. On a big move, 18% say, they could make a lot of money. Look at the last earnings report - odds look excellent that this could happen.

But what if this time it doesn't. ( Remember our good friend Murphy?) Look at the delta (time) factor. These options lose about 10% of their value EVERY DAY! In a week's time, they will have lost 60% of their value. By they day before earnings, they will have lost almost 99% of their value to time erosion (barring increases in volatility - or vega). So any move less than 7 percent can result in a loss of almost all premium.

So yes, you can double your money in two weeks. But you can also lose it all if the stock moves less than 7%! That's not a gamble I like to take. At least Las Vegas offers free drinks and pretty girls.

Here's a better approach, that makes time work in your favor instead of against you, and doesn't care whether the stock price moves up, down or sideways!

- Probability of success : greater than 90%

- Risk : Reward : around 1 to 4

- Duration: 14 day trade

- Minimum Investment: $323

- Maximum Investment: none

[membership level="0"]

The remainder of this posting is restricted to TradeJolt members only. Please login using the link below. If you are not a member yet, click below to sign up for our FREE 30 day trial membership.

[/membership]

[membership level="1,2,3"]

Since time is our enemy when we are buying options, the trick is to sell options in the week prior to our position, at a position FURTHER OUT OF THE MONEY. By going short a call at a strike of $57 and short a put at $46, we are making time work in our favor for the first week. The shorter term options lose value faster than the long term options erode value, meaning we could buy them back cheaper than what we paid for them. Our position becomes theta positive for those seven days. Our hope is that during that time, volatility on the Jan 31 positions will have spiked, while volatility on the shorter term options will not have moved much. Why not? Because those don't offer protection on the earnings report date and thus are not being bid up by options buyers.

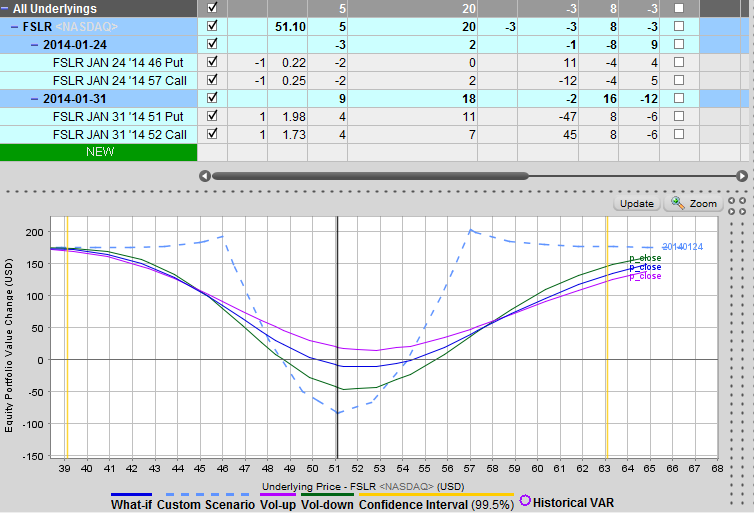

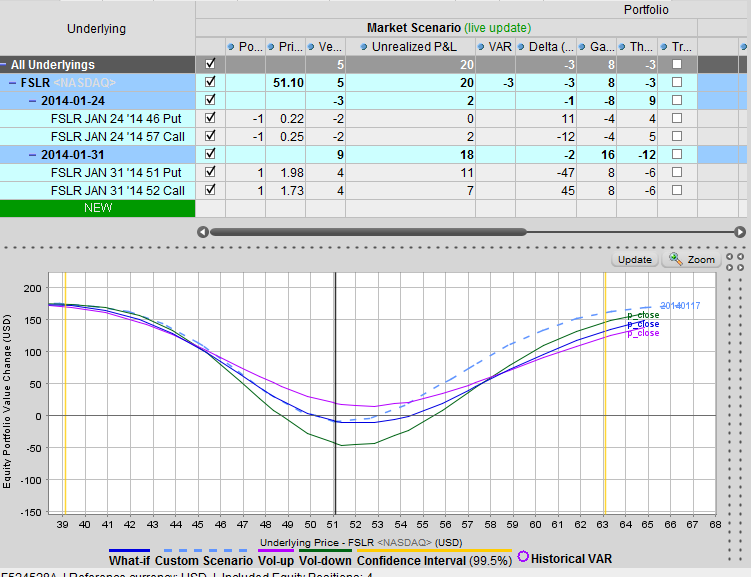

Here's how that risk position looks on the day we initiate it. Note how it seems to make money at just about every price point!

But that's misleading. We have to add time erosion into the play.

click to enlarge

Now, as you can see, as time erodes our positions, we see that we could lose as much as $85 if prices remain between $48.50 and $55, and make a maximum of around $200 at other prices.

click to enlarge

Already, that position looks fairly attractive, as we've seen that a price move of greater than 7% is very likely.

We stand to lose around $85 if it doesn't and make around $200 if it does.

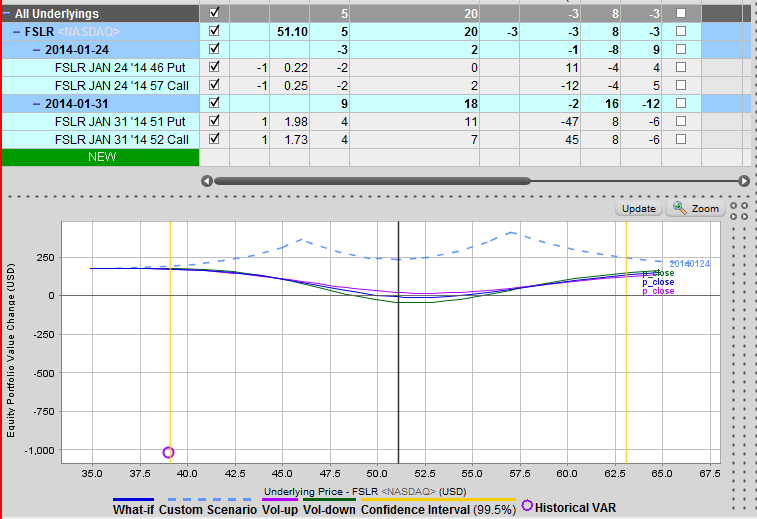

But we've still left out and important factor: volatility. If history repeats itself, we could see an increase of volatility between 70% and 150% on our January 31 long positions, which will increase their value. The graph below shows you what would happen if volatility were to rise to 100% levels, as has happened 4 out of 4 of the last quarters.

Now we are making money at every price point, between $200 and $400. We're not only making money on big price moves, we also make money if the price never changes!

So now the question becomes, what is the probability that volatility stays the same. It's difficult to compute that figure mathematically, but it is a very remote possibility. For volatility to remain the same, essentially uncertainty must drop. For that to happen, and for stakeholders not to grow increasingly nervous as a potential loss of 10-18% on their stake approaches, somehow they would have to be certain of what was to unfold.

How do you get such certainty? You get it when management releases an early glimpse at what the coming report will reveal. If that happened, bulls and bears would know what they have to reckon with and would be less willing to hold options positions, lowering the cost of these and effectively dropping option volatility to normal levels.

From time to time, such early glimpses do occur, although they are fairly rare. And when they do occur, it's usually because nervousness about the stock's prospect are running so high that management wants to "calm the waters". In other words volatility has probably already spiked at this point, and the position would be very profitable.

So our position will place stop limits on all positions as soon as volatility reaches a high level, regardless of how much time is left until the date of the earnings report. This way we have a better chance of locking in profits even in the unlikely event of a surprise early earnings revelation.

I would put the odds of an early glimpse at less than 10%. Even if it happens, I have a chance of making money, due to already heightened volatility, although probably less than the full $200. If the preliminary announcement is very positive or very negative for the stock, meaning a big price move of the underlying, I make a doubling of my premium regardless of volatility. The chance of big move (look at the last 4 quarters) are probably over 75%. So over all I would rate my chance of profiting on this investment as follows:

90% chance of making $200 - $400

5% chance of making $100

5% chance of losing $90

This is close to a risk reward ratio of 1 to 4 with a 95% chance of benefiting. In my book, that's a great speculative investment.

Remember, on earnings day volatility will plunge. So you need to exit this investment about 1/2 hour before options trading closes before the after-hours announcement, or earlier if volatility is already sky-high, using trailing stop positions.

By the way, in this position, you cannot lose more than what your original premium cost was. I would not recommend it, but you could therefore allow the long positions to keep running on the hope for a home run. Volatility is certain to drop, but a massive stop move would more than offset that.

Stay posted, and you'll see how we've done!

[/membership]

[print-me target="#post-%ID%"]

Status report 23 jan:

On today’s big drop in the market in general, our trade has turned positive.

Our near term Jan 24 options, which we sold, are still out of the money and have lost almost all value.I do not believe the stock will drop below its strike level of $46 by the end of the market today. So we will allow both of these short positions to expire worthless.

I believe the stock will bounce at the $46 floor, and move up from there over the next few days. So I will place a stop limit about 10% away from the profitable position, and allow my losing position to ride.

Volatility has risen by about 10% since we entered this trade. So our main “profit driver” has not yet kicked in.

click to enlarge

click to enlarge