To Taper or Not To Taper – That Is The Question…

[print-me target="#post-%ID%"]

The Fed meet today and tomorrow to determine whether or not they will begin "tapering", a euphemism for ending the $85 billion of money printing they have been doing every month in a desperate attempt to revive the sluggish US economy. Most economists believe inflation figures are too low for the Fed to begin tapering this month, but a full 38% of those polled do see an immediate tapering.

I believe there will be a postponement - consider it a Christmas gift to the stock and bond markets - but I'm not confident enough to bet on it! However, I'm more certain about uncertainty, if you'll pardon the cheap pun. I foresee a continued increase in uncertainty or volatility, peaking tomorrow afternoon at the time of the Fed statement.

This presents the following opportunity, which is delta neutral - in other words it doesn't care in which direction stocks move - to make money. It will only lose money if uncertainty stays stagnant or drops between now and tomorrow

and if the price of the index remains stable, moving only in a tight range.

- Probability : greater than 70%

- Risk : Reward : around 1 to 7

- Duration: 2 day trade

- Minimum Investment: $37

- Maximum Investment: none

[membership level="0"]

[/membership]

[membership level="1,2,3"]

If you have enough margin, my preferred play is a reverse calendar, buying a March expiration call and put far out of the money. Then I buy a short term option at the money ($180 at time of trade)

SPY Mar21'14 189 CALL collect $.95

SPY Dec20'13 180 CALL spend $.80

SPY Dec20'13 180 PUT collect $$2.36

SPY Mar21'14 168 PUT spend $2.46

net cost ($0.05) per share x 100 shares x 100 options = -$500

Note well that time is my enemy here, but any price changes (up or down) work in my favor. Every day that passes I lose about 20 percent to time, as my December long positions lose value much faster than my March shorts degrade. However, I am expecting volatility to rise sharply (somewhere on the order of 20% - 40%) , which will positively impact the December options but hardly move the March ones. Meanwhile, I expect possible large index movements with moves of 3% to 5% easily in the works, which could make the position profitable even well before the Fed decision, allowing me to use stop orders to lock in profits.

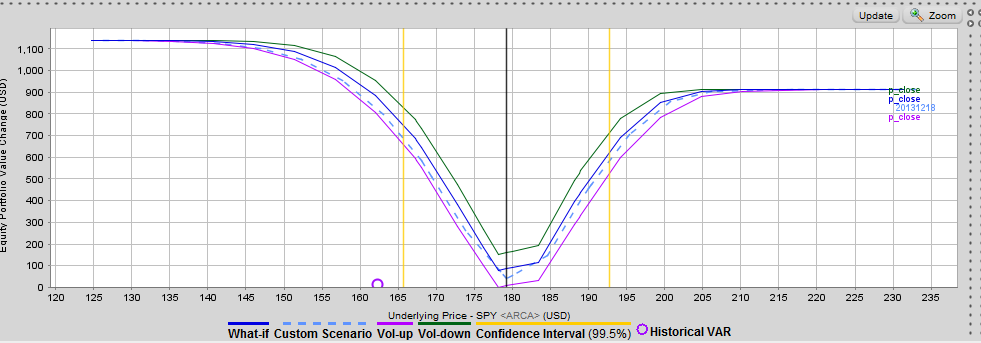

Here's how the play works graphically, assuming I am right about the increase in short term volatility by Wednesday afternoon.

click to enlarge

As you can see, the graph presents a very attractive play. The blue dotted line represents the profits at any given price level on Wednesday afternoon. No matter what the price of the SPY index after the Fed releases their notes, we make anywhere from $30 to $900, with a probable profit of $400 if prices move by $8 - $9 dollars, as I anticipate.

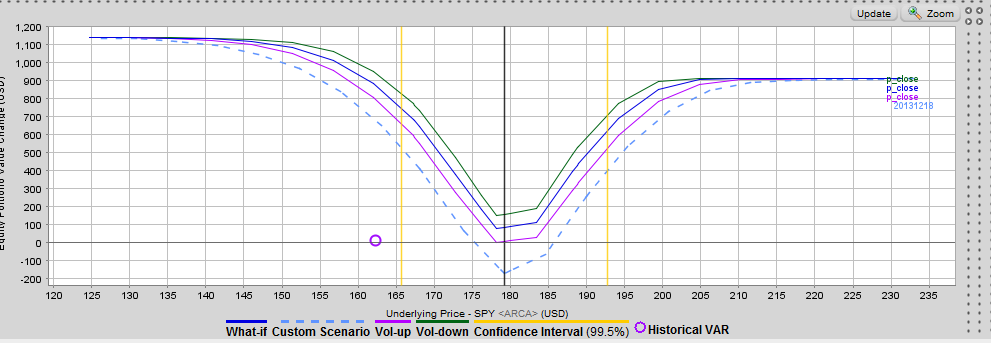

But before you get too excited, let's look at the downside. What if I'm wrong, and volatility actually drops (certainty increases)? Let's take the assumption that it drops in the short term by 30%, but stays unchanged in March.

As you can see, in this event, we could lose as much as $180. However, if volatility drops but the price moves above $186 or below $175, we still break even.

In my opinion, the likelihood of this happening is quite small. Only on two occasions in the last year has volatility reached such low levels on SPY. If this were to happen, it would almost require a message from the Fed that is "perfectly transparent and simple". A perfectly transparent Fed statement is almost an oxymoron. But again, I intend to possibly exit the position before the Fed statement release.

So overall, I would say this trade has a risk / reward ($180 / $900) position of between 1:3 to 1:4, with a greater than 70% probability of success. Why so much chance of success? Because a large price move is likely which makes the play attractive even at low levels of volatility.

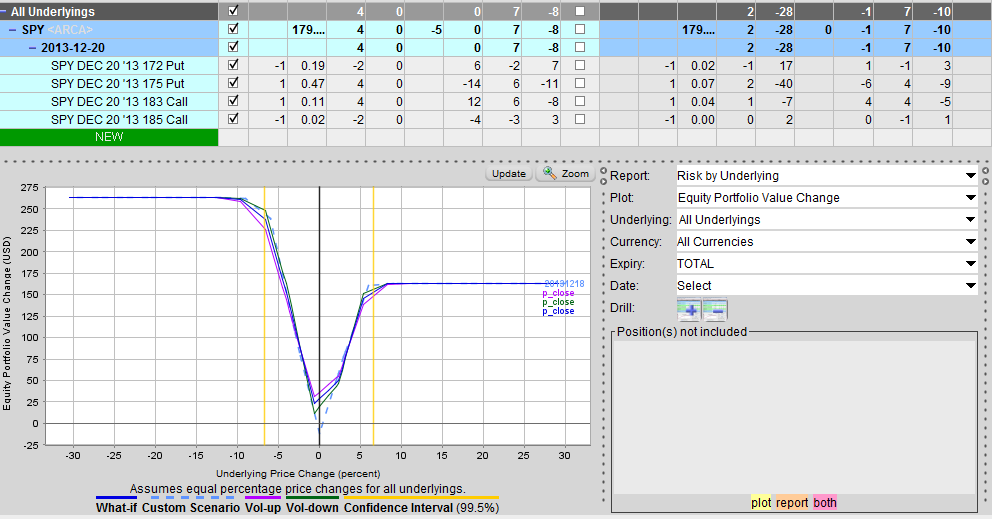

For those of you who cannot do reverse calendars because of your broker's margin requirements, consider instead doing it all in the same month, using what is called a "reverse iron condor". This involves buying both a call and a put a few points away from the currently trading price, and selling calls and puts further out in the same expiration period.

How far from the actual price you place your inner buys is a science in itself. The difference between the strike price of the long call option and the long put option determines the range within which the position will result in its maximum loss. The wider the difference, the lower the maximum loss potential.

I chose a trade that result$ed in a $37 out of pocket debit, which is also my maximum loss, which will occur if the position ends between $175-$183 AND volatility does not increase.

SPY Dec20'13 185 CALL sell

SPY Dec20'13 183 CALL buy

SPY Dec20'13 175 PUT buy

SPY Dec20'13 172 PUT sell

Here's how I see the trade shaping up, if volatility does not change:

As you can see, you risk losing around $10, and can make as much $260, with a more likely gain of around $100. The maximum possible loss - if volatility drops to zero - is $37. That's still a great risk reward ratio of about 1:7 to 1:10.

In all cases, exiting the trade is just as important as entering into it. You must pay attention all day Wednesday, with your finger on the trigger. I will be looking to exit this trade just at the time of the Fed announcement, which will be the period of maximum uncertainty. If it is not profitable by then, consider cutting your losses early.

[/membership]

Disclosure: Options investing is inherently risky. This is not a solicitation to buy or sell. Please read our full disclosure on this site.

[print-me target="#post-%ID%"]

During the day, just prior to the announcement, this trade was slightly positive, after the VIX (volatility index) climbed to 16.74.

Since profits were only moderate at that point, and I still expected a market move higher than 3 percent, I decided to hold off on closing positions, knowing my downside was fairly limited $138 loss per option.

At 2:00 the news came, as as expected volatility dropped instantly to around 14.20. I expect it will continue coming down another 10% or so tomorrow to resettle at its last month average of around 13.

The Fed announced a beginning of tapering, reducing bond buys from $85 billion per month to $75 billion. This was treated with glee by stock markets, and reluctant acceptance by bond markets. Stocks rose about 1.8% by days end, and did so on 8 times the normal volume of shares traded. Bonds, after heavy zigzagging ended mostly flat.

My view is that we’ll see a continued rally tomorrow, taking the spy up another 1% to 2%.

These are the measures taken to try to manage our options positions, which were not yet profitable.

1) I sold the near term long puts in the calendar call, at a $1.38 loss per share. This is because these still have sufficient value that is likely to erode entirely by Friday’s expiration.

2) I held onto the short term calls, which have increased from $0.80 to $1.78, as I believe tomorrow will bring another big jump up, and the delta rise in value should exceed the loss from vega (time).

3) Finally, I will hold onto both the March short calls and puts for now, as these should erode in value with time and dropping volatility, so I will be able to close them for less money in a few weeks. Meanwhile, I will be buying shorter term call spreads to capture the upside move that I expect, without sacrificing too much to time.

Stay posted for the results of this trade.

For those who due to margin requirements have had to use the reverse iron condor, I have chosen to close the put spread , for a loss of $0.30 per share (or $3.00 per option). This leaves the call spread remaining, which so far have increased by $0.14 per share. If SPY jumps to 183 by tomorrow, which is still possible, these should appreciate by another 50 to 60 cents per share, yielding an overall profit on the trade. Stay posted.