The Sky is Falling ! The Sky is Falling !

Last week we made an option play betting uncertainty would rise into the congressional battle over funding the government over the next quarter. As you know, neither side flinched in that game of chicken, and the US government went into partial paralysis.

Look over the last trade: we did pretty well making about 3 times as much money as we were willing to risk, in about four days.

Guess what? Not much has changed, but now the stakes are higher. If Congress cannot come to an agreement by October 17 over extending the debt limit, the US government will come to a screeching halt. Economists worldwide are in virtual agreement that this would provoke a worldwide crisis larger even than the 2008 Lehman meltdown.

For that reason, most people, myself agreeing, don't think it will happen.

At the last minute, given what is at stake, one side or the other - in this case the Republicans - will flinch and give in, and a compromise will be found kicking the can down the road for another six months. Democracy at its finest!

But when you are talking about the clash of politicians' vastly overinflated personal egos, enormous sum of money, and lifetime political careers hanging in the balance, as my son would say : "S(tuff) happens".

{Editors note: This is a pg rated blog}

Take another glance at the volatility index. If my son's deeply nuanced philosophical words are right, I think there is a very good chance that the VIX will breach its ceiling at 22.50 and rise to the levels indicated in yellow, between 27 and 45.

I would say the likelihood of that happening between now and October 18 is no more than 50%. But I do think the VIX has a better than 75% chance of going over 22.

So here's how I will play it, with a wonderful risk/reward ratio:

[membership level="0"]

Register for a FREE 60 day trial today. There is no initial cost to try out the service, so join today!

Register

[/membership]

[membership level="1,2,3"]

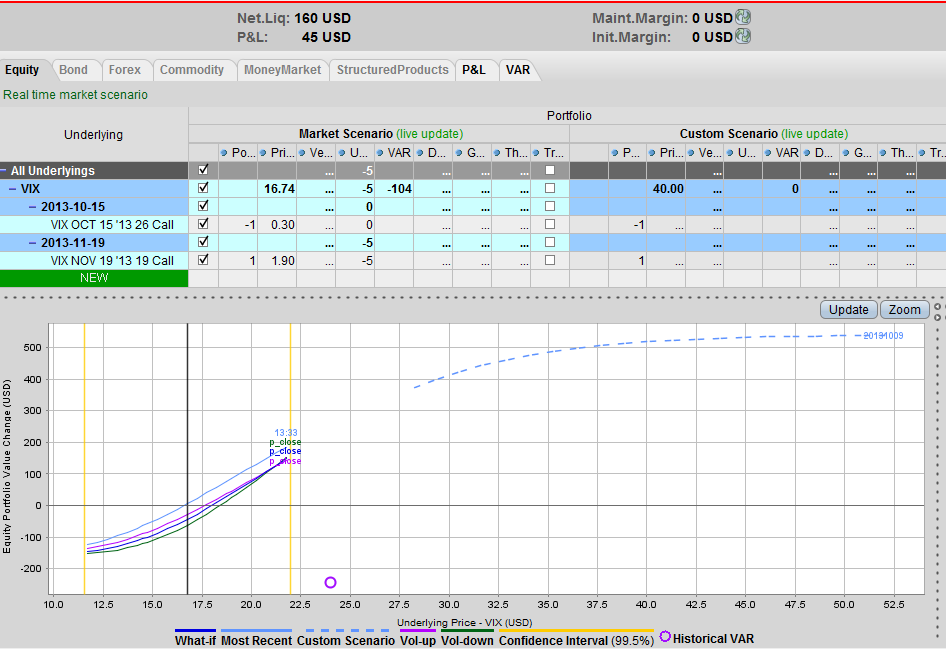

SELL OCT 15 26 CALL @ $0.25

BUY NOV 19 19 CALL @ $1.95

NET DEBIT $1.70 X 100 = $170

This time I've chosen to do a kind of weird diagonal calendar spread, selling far out of the money options at 26 that will expire in about 1 week and buying closer to the money calls that expire in 5 weeks time. This means that for 1 week or so I put off the negative effects of time eroding my position.

The way I see it, the politicians will not come to a conclusion until 1 or 2 days before the October 17 deadline. So by postponing the decline of time value (Theta) from my overall position in the first week, I'm maximizing the "bang" that I will get for my buck when the real decisions come down to the wire.

If volatility spikes up to the moon before that, the shorter term option limits my profits, but the lower strike on the longer term option still guarantees me a gain that maximizes out at $500.

Once that date passes, I am no longer limited in what I can earn on a volatility spike. If volatility were to move as high as 40 , this position could earn around $4700.

In all likelihood, I will exit this position on October 19, the day of the deadline, or at least protect any profits that I have incurred by then. Here' how I expect time to have shaped my options positions on that day.

My maximum risk is my outlay, namely $160. By exiting by the 19th, it is unlikely to be that large, even if volatility drops because a debt agreement is reached easily. The likely range of maximum gain is in the $1000 to $4000 range, if the craziness really starts climbing.

[/membership]

Disclosure: Options investing is inherently risky. This is not a solicitation to buy or sell. Please read our full disclosure on this site.

[print-me target="#post-%ID%"]

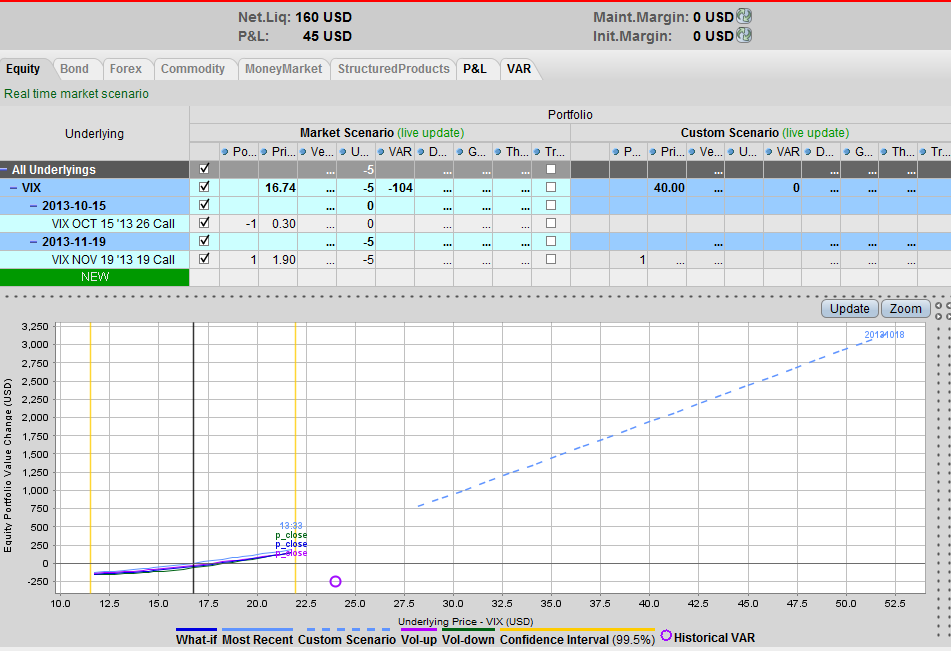

Quick followup on October 14: The first of my positions (short of OCT 15′ positions at strike of 26) will expire at close of day tomorrow.

Volatility has not reached 26, and unless this happens tomorrow, we will profit by the full 25 cent value from these premiums. This has helped prevent too much time erosion from my November 18 calls, which do lose value over time.

At present I am slightly down overall, by 5 cents per option, on the original position.

However, when it looked like the Senate might actually come to an agreement last Friday and volatility dipped notably,

I decided to hedge the position.

I sold an October put below 16 (this was out of the money when I transacted it).

I used a portion of that money to buy 8 times that number of deeper out of the money puts for the same month, at 13.

This resulted in a net credit, of 5.6 cents on average.

This hedge would make money if a solution was reached and volatility dropped below 14, which I expect. Since it was done at a net credit, it will also make money if volatility stays high (above 16). Between 14 and 16 it could lose a limited amount of money.

So far, this position is profitable, since volatility today climbed back above 16. It offsets the small loss of my original position, making me net positive overall if I were to have closed out before market close today:

click to enlarge

I believe this thing will get settled out by tomorrow, but we could still see a market slide (and VIX rise) first. Depending on the rapidity and force of that move, I may take a portion of any profits off of the table. But if there is a lot of uncertainty, I will leave all positions unchanged. The hedge gives me downside protection but only until market close tomorrow.

To my readers, I regret that I’ve not been able to post timely information on the end of this trade. Life intervened, in the form of a painful appendectomy, which sidetracked me for a number of days.

I did end up losing a small amount on this trade, and will catch up with you later to post final results.