Featured Trade Wins Big

Once again, the technicals triumphed over the fundamentals. Look at my featured trade posting of last week. I love this company, and its position in the interplay of world commerce. Sales and earnings are soaring, so you could easily be bullish about this company's long term prospects. But the psychology of the market was screaming "SELL". Let's face it, the public is downright scared. This was reflected in APKT's chart, as I showed you.

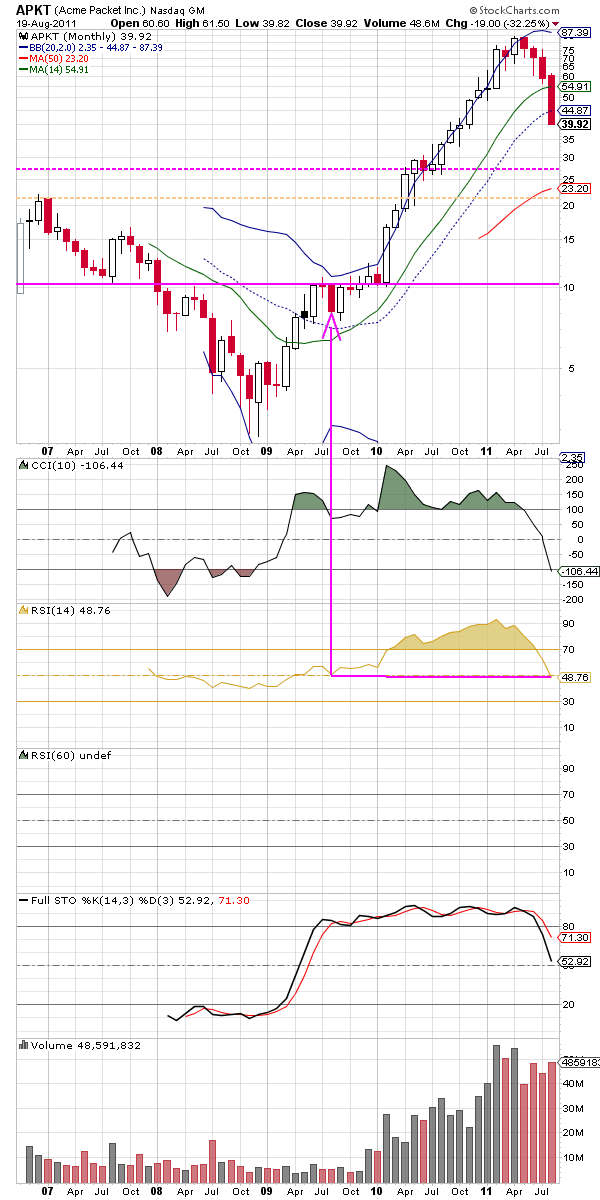

Here's how it played out:

Look at my featured trade. I had said I would sell it short if the stock traded below $54.20 with a limit price of $54. I got in at $54.15, on the short side, and had to hang on for a fast toboggan ride down to $40. When it bounced up from here, I exited the trade, because that was where I had perceived a weak floor to be (see my posting).

So far so good: a quick 17 percent in less than two weeks. And we are not done.

I was looking for a small bounce at $40, up to a previous low. That low was at 45. So when the stock turned south there again, I was back on board, with a short at $42.50. the stock is now trading at $39.92 at close on Friday. I have a stop position at 41.90, which will give me a small loss if it triggers. I expect the stock to sink lower to at least $35, before it encounters another bounce.

Long term, technicals look pretty dismal for this stock. I expect a short term move - within the next two weeks - down to the floor around $30. A bounce there probably will be nothing more than a "dead cat bounce" , as this animal is expending one of its nine lives.

The monthly long term wave pattern suggests an ultimate drop to the $23 level. My rsi(14) trace line suggests a price even lower, to around $10. YIKES! (Caution: comparing rsi strength ratios to price levels is inaccurate when you surpass the period length of the average, in this case 14 months. The only thing the chart is telling us is that the RSI "wants" the price to move lower than its level 14 periods ago, when it was trading at 28.)

Does this have to happen? Of course not. Be cautious and use stop limits to limit your losses if the market surprises you.

As always, remember never to trade more money than you can afford to lose. By nature, trading in stocks is risky. Make sure you read our disclaimer. Good luck!