TESLA Rockets Up – What To Do Now?

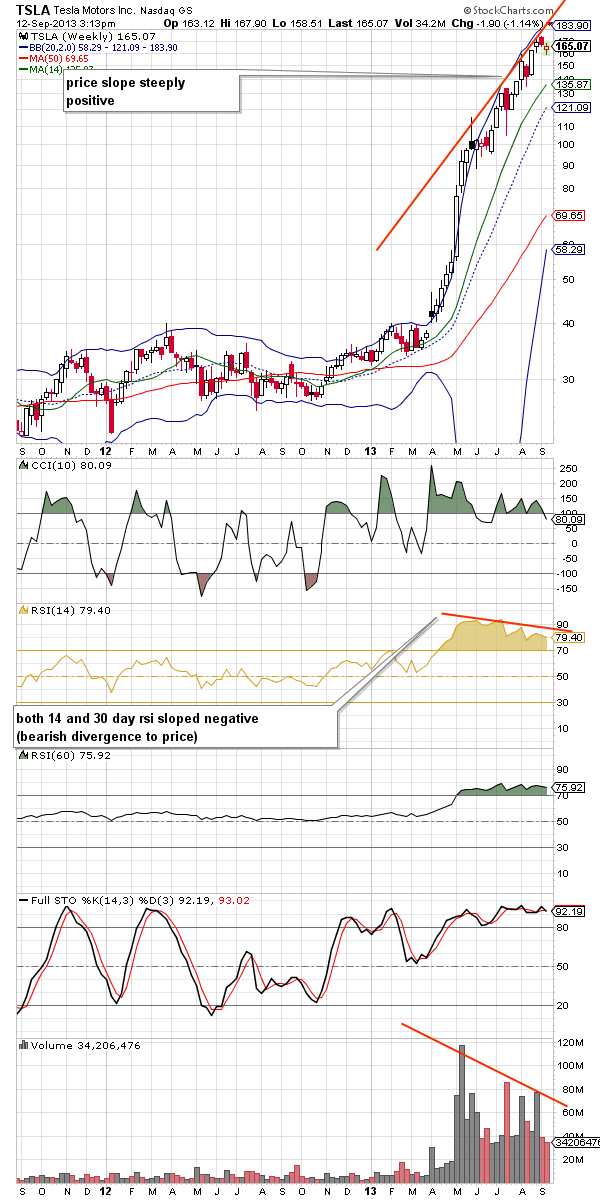

Tesla Motors (TSLA) is probably one of the most popular success stories on the stock market for 2014. Since its debut in July of 2010 at $17, the stock has never had to look in the rear view mirror. Last August, Elon Musk, the company's flamboyant CEO surprised investors and analysts with better than expected sales figures and earnings on already ambitious growth plans. The stock promptly shot up again in the gravity - defying move to today's $190 level.

This puts many investors, many of which were until now bullish on the stock, in a quandary, summed up by one investor's blog comment: " I love the car. But I would not buy the stock yet nor would I touch a short position with a 20 mile pole."

That's kind of the way I feel about Tesla right now. So I'll show you two quick ways - using options - to profit from that situation, with limited risk if you are wrong and Tesla shoots to the moon or drops like a rock.

[membership level="0"]

Register for a FREE 60 day trial today. There is no initial cost to try out the service, so join today!

Register

[/membership]

[membership level="1,2,3"]

The first solution is fairly simple to understand. If you have $10,000 you are willing to bet on Tesla, but you just think the price is too rich, consider selling a put at a strike price of $100 expiring Jan 16, 2015. This will put $1530 in your bank today, minus $10 or so of brokerage fees. If the stock keeps rocketing up, you won't own the stock, but at least you'll have made money to offset your chagrin. Hey, that might even cover 1 month's payments on your next Tesla roadster!

But what if the stock moves down fast on some horrible news? You may then no longer want to own it, even at $100. Well, my suggestion is to immediately (the same day you sell your naked put), place a stop limit order to sell 100 shares short.

SELL 100 shares TSLA stop 95, limit 80.

Chances are very high that this will be sufficient to get you out around $95. As the situation evolves, you may want to remove this order or in fact move it higher above $100.

Can you lose money? Sure. If tomorrow an earthquake knocks out the Tesla factory and devours half its employees, the stock could gap down to zero overnight, blowing past your stop limit order. But just think how much worse off you would be if you'd indulged in your whim and bought the stock at its current price of $165 (about $80 K worse off)!

If you like the idea of a naked put but just don't have that much cash in your piggy bank to risk on one stock, then consider selling a bear spread. For each put option you sell at $100 - committing you to buy - you sell a put option at $97.50. This limits your risk to a loss of $2.50 per share x 100 shares.

This allows you to collect $106 immediately. You get to keep that money as long as Tesla doesn't drop below $100 over the next year and a half. And even if it does, you never risk losing more than $250 in a worse case scenario, for each option spread you sell.

The second option strategy, which I will show next is the one I prefer, though it is more complicated. It does require opening a margin account and being permitted to do calendar spreads by the brokerage in question.

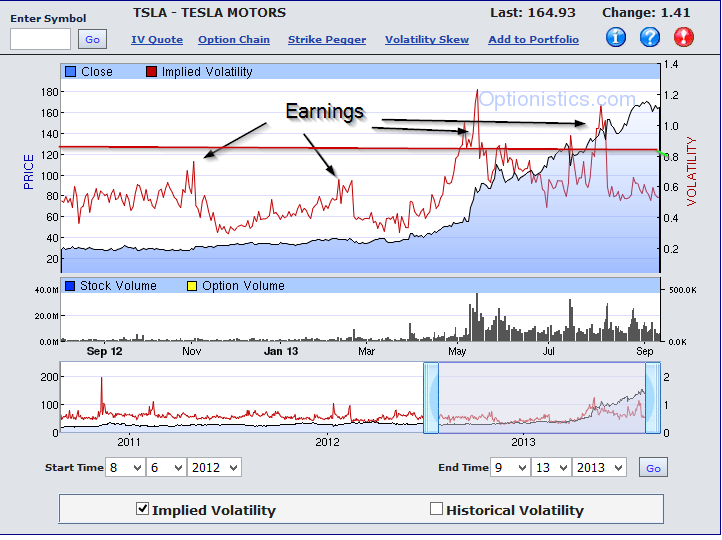

Take a look at this graph of historic volatility of TSLA options over the last year. Notice how the volatility spikes up just before each earnings report?

That doesn't mean volatility has to rise, but chances are great that it will. Next earnings report for TSLA is around November 8, and my bet is that volatility will reach a level around 80%, possibly as high as 120%.

That discrepancy is what I will use to try to make money on Tesla. I think TSLA could go either up or down, although I think the likelihood of a downward movement is just slightly higher. So I'll structure my options play - called a reverse diagonal calendar spread - to make more money if it goes down than if it goes up.

When volatility rises, it usually does not affect all options prices equally. Just before the earnings report buyers and short sellers of Tesla will hedge their positions by buying the options that provide the best protection at the least cost, which is the nearest term that expires after that report. In Tesla's case, there are no November options, so December offers the cheapest protection. I expect December options to start climbing around October 15th or so, then plunge again after the earnings release, on or around November 8th. I don't expect the March 2014 options to move up much, and certainly a lot less than the December lots.

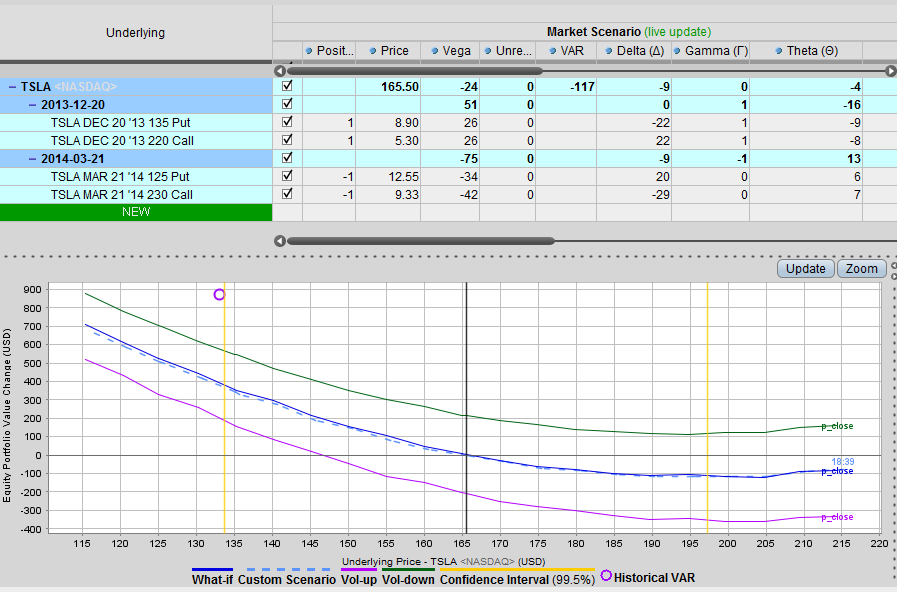

Given those expectation I buy a straddle on the December options - making them fairly neutral to price direction (delta neutral) - and sell a further out of the money straddle for March 2014. This results is a net credit to my account of $768.

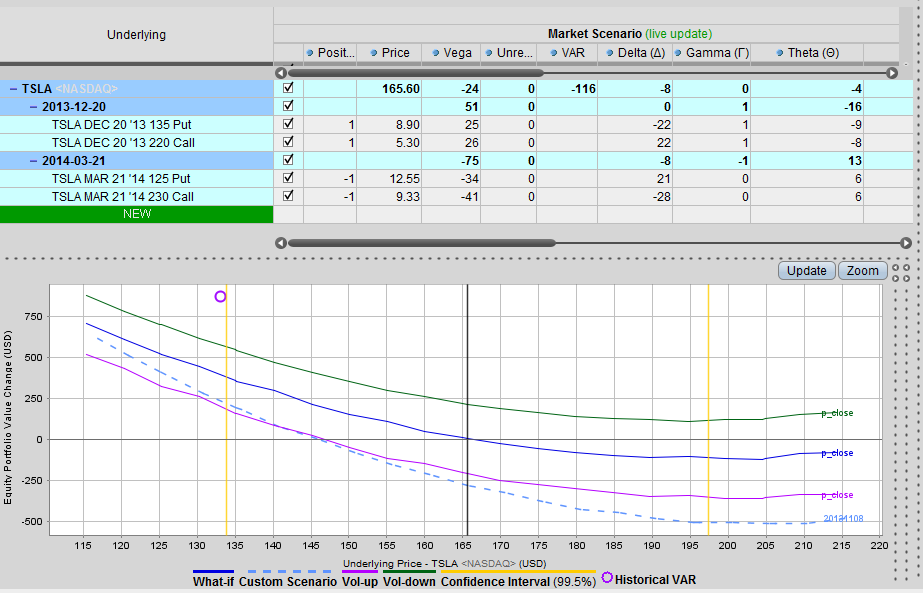

Here's how the position looks when I take it today:

The blue dotted line represents the profit or loss on the position at different price levels of the stock, at the assumed level of volatility. So as you see, at first it seems the play will lose money at prices above $165 and seems to plateau out at -$100, but make money if the stock moves down in price, up to $600 on moves to around $135.

Not very compelling you say, you might think. But wait. First let's look what happens as time advances. Time is the big enemy of options that you buy, but time is also the inseperate bosom buddy of options that you sell.

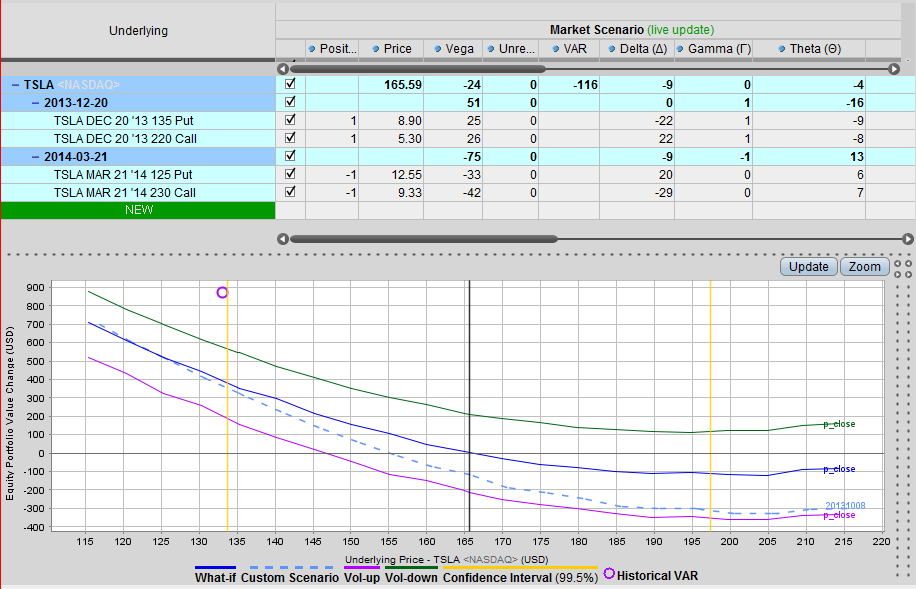

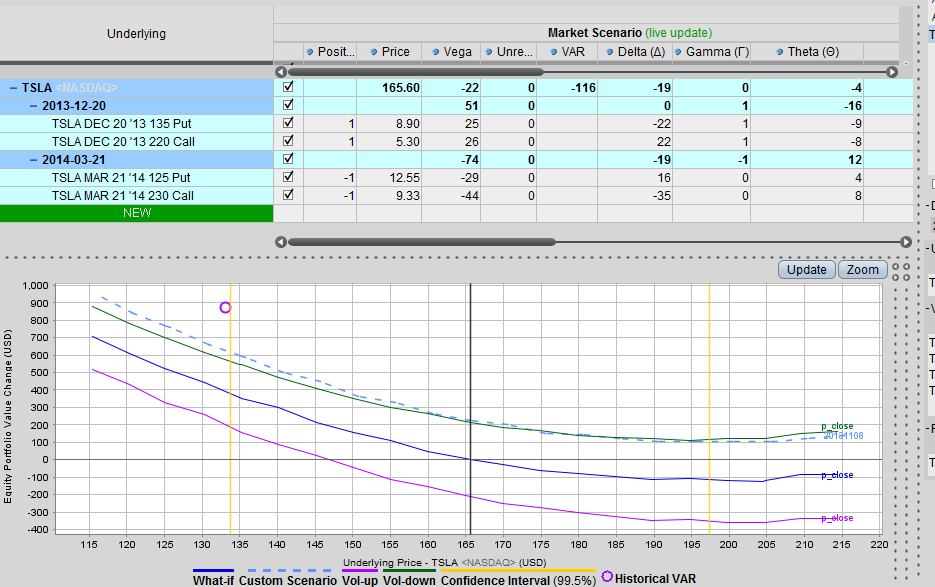

So here's the evolution of the trade one month out.

And here's the trade just before the earnings report:

"Stop!" , you scream in protest. "Now you're losing up to $500 and you're losing money at any price above $145. How is this supposed to be a good way to make money?"

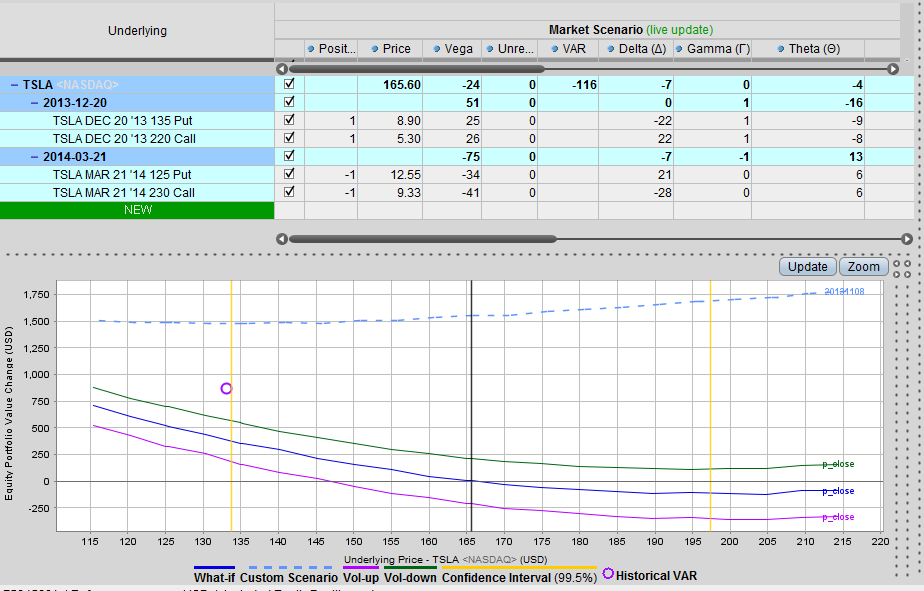

Now we'll allow another important actor in the option play to enter the stage: volalitility. Check out how things evolve if we get a volatility spike like I expect, one that averages what the last four volatility spikes have been.

Now we're making money at every price level, anywhere from $100 to $700 at the most statistically probable price moves Tesla is likely to make.

Even bigger gains are possible, if volatility really spikes like it did in the last 2 quarterly reports. The graph below shows retuns at 120% volatility.

As you can see, this would produce earnings of around $1500 at every price level of TSLA.

To sum up, here's how I see the risks reward relationship on this options play:

- On the risk side, if TSLA volatility moves down while prices move up, I could lose money.

- I rate the probability of uncertainly dropping before earnings at less than 1%. It may stay oscillate up and down but it should trend higher. Look at the graph of historical volatility over the last four quarters. It never dropped. An examination of volatility in other growth stocks similar to TSLA shows the same clear cut trend.

- What would it take to provoke a drop in volatility?A buyout by another company would. But a sudden buyout implies a price increase of around 25% or so, in which case we would make money even at lower volatility.

A pre-earnings announcement into what the earnings will report. That's been known to happen in the stock world, but its a pretty rare event. I'll take my chances.

- Even if volatility were to drop, my most likely losses are in the range of $250, not $763, based on TSLA dropping to its lowest historical volatility level. (A drop to 0 volatility is impossible, as it implies perfect certainty which does not even exist in the case of bankruptcy valuations.)

- On the other hand, the odds on the upside are very high. Statistically, there is around a 90% probability that volatility will tick up. The question, in my mind, is to one of degree. Will it rise less than its average at 80% or more than its average?

- If it rises less than average say 30%, then I make anywhere from $0 to $800, making least when prices are highest and most when prices are lowest.

- If volatility rises only as much as it has done on average over the last four quarters, I have a 100% chance of making between $100 and $700.

Those are odds I like. I'll be taking this position tomorrow. We'll keep you posted on our trading results.

Disclosure:This web site discusses exchange-traded options issued by The Options Clearing Corporation. Options involve risk and are not suitable for all investors. Prior to buying or selling an option, a person must receive a copy of Characteristics and Risks of Standardized Options. Copies of this document may be obtained from your broker, from any exchange on which options are traded or by contacting The Options Clearing Corporation, One North Wacker Dr., Suite 500 Chicago, IL 60606

TradeJolt.com is not a registered investment advisor or broker-dealer. We do not make recommendations as to particular securities or derivative instruments, and do not advocate the purchase or sale of any security or investment by you or any other individual. By continuing to use this site, you agree to read and abide by the full disclaimer.

[/membership]

[print-me target="#post-%ID%"]