SPY – Summary of Rolls from 06 -11 August

The last few days have been a maelstrom of activity for me, recording new videos for the channel TradeJolt on Youtube, adding new credit card processing functionality to this website, and preparing the launch of a new blog dedicated to cryptocurrency finance, decryptofied.com.

We're also busy working away at an exciting new functionality to this site, which will add a marketplace for option deals between buyers and sellers of trade ideas. The idea is to allow publishers to post their best ideas, and to reveal enough about the idea for other viewers to wish to pay a small fee to reveal all the intricacies of the trade. We'll be adding rating functionality, and feedback. We think it will be a very powerful and popular feature.Expert option traders will have a new means of remunerating their research, while viewers of this site will have more of an opportunity to benefit from great trades.

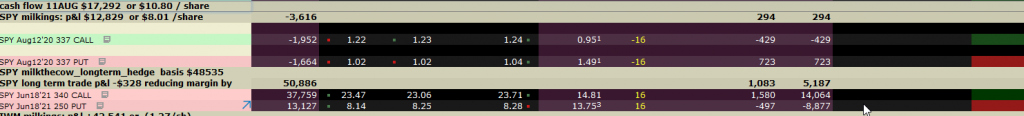

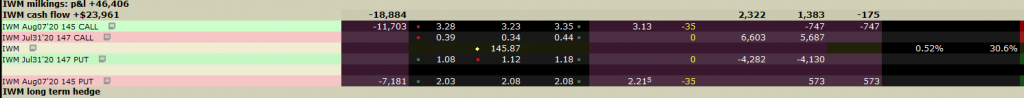

So pardon the lack of detail as to the rationale for the following trades. Overall the strategy continues to increase in profits over time. Our earnings per share from selling options have grown this week from an accummulated total of $6.63 per share to $8.01 per share.

By the way, today on August 11, we were assigned on our 335 in the money calls. As my readers know, I like to try to avoid assignment,

as it can temporarily add to the overall margin requirement of a position, until the position can be closed out. Other than that impact,

it is not something to be concerned about, as we are covered by our outer LEAP options hedges.

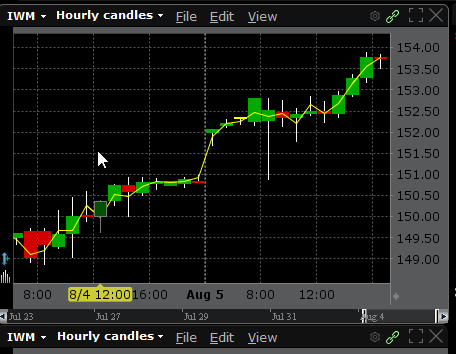

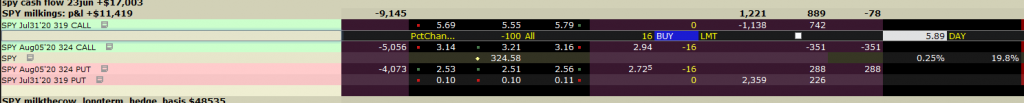

A list of the trades made on each day follows beneath the graph of SPY's movements.

SPY has continued to march higher.

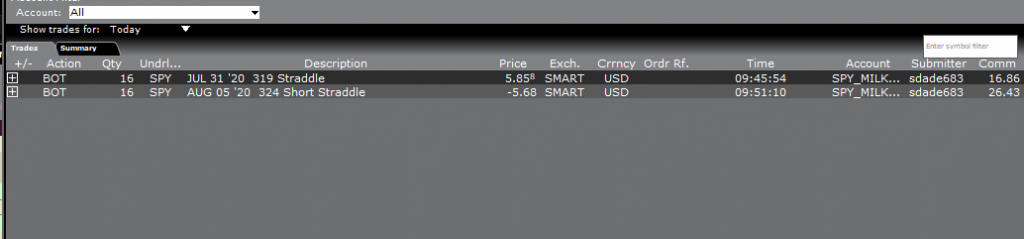

aug 6

bought back 332 call for $2.04 sold for $1.78 loss of $0.26

bought back 330 put for $0.41 sold for #1.09 gain of $0.68

net gain $0.42 /share

sold a 333 call for $1.41 exp aug 7

sold a 333 put for $1.13 exp aug 7

cash flow -$2.45 + $2.64 = $0.19

size: 16 contracts

basis $48,535 or $28.56 / share

cash flow $13,219 or $8.26 / share

p&l $10,613 or $6.63 /share

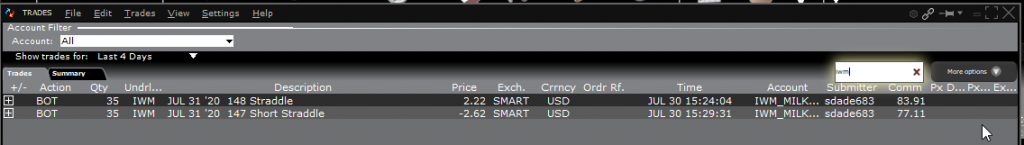

aug 7

bought back 333 put/calls expiring tomorrow

bought back 333 put for $0.64 cent sold at $1.14 for gain of $0.59

bought back 333 call for $0.41 sold at $1.09 gain $0.68

adjustment made

bought new 333 put expiring aug 7 for $0.66

sold same 333 put exp aug 7 for $1.13 gain of $0.47

sold 334 aug 10 put for $1.37

sold 334 aug 10 call for $1.44

cash flow -$0.64 - $0.41 - $0.66 + 1.13 + $1.37 + 1.44 = $2.23 / share

size: 16 contracts

basis $48,535 or $28.56 / share

cash flow $14,780 or $9.23 / share

p&l $13,397 or $8.37 /share

aug 10

bought back 334 aug 10 calls at $1.47 sold for $1.37 for $0.10 loss

bought back 334 aug 10 put at $0.23 sold for $1.44 for $1.20 gain

sold 335 call / put for 0.48 put 0.74 call

335 aug 10 calls sold for $0.73

335 aug 10 puts sold for $0.48

ttl $1.21

cash flow 1.70 - 1.21 = 0.49 cents x 16 contracts

size: 16 contracts

basis $48,535 or $28.56 / share

cash flow $15,564 or $9.72 / share

p&l $15,117 or $9.44 /share

aug 11

assigned at 335

bought back at $336.93 on 1000 shares and 336.50 on 600 shares

loss of $1.93 and 1.50 respectively

loss overall:

10 x 100 x 1.50 = ($1,500)

+ 4 x 100 x 1.93 = ($ 772)

+ commissions = ($ 10)

total =($2282) or $1.43 per share

sold new 337 aug 12 calls and puts for 1.55 put+ 0.96 call or credit of 2.51

cash flow gain of 1.08 /share

size: 16 contracts

basis $48,535 or $28.56 / share

cash flow $17,292 or $10.80 / share

p&l $12,829 or $8.01 /share