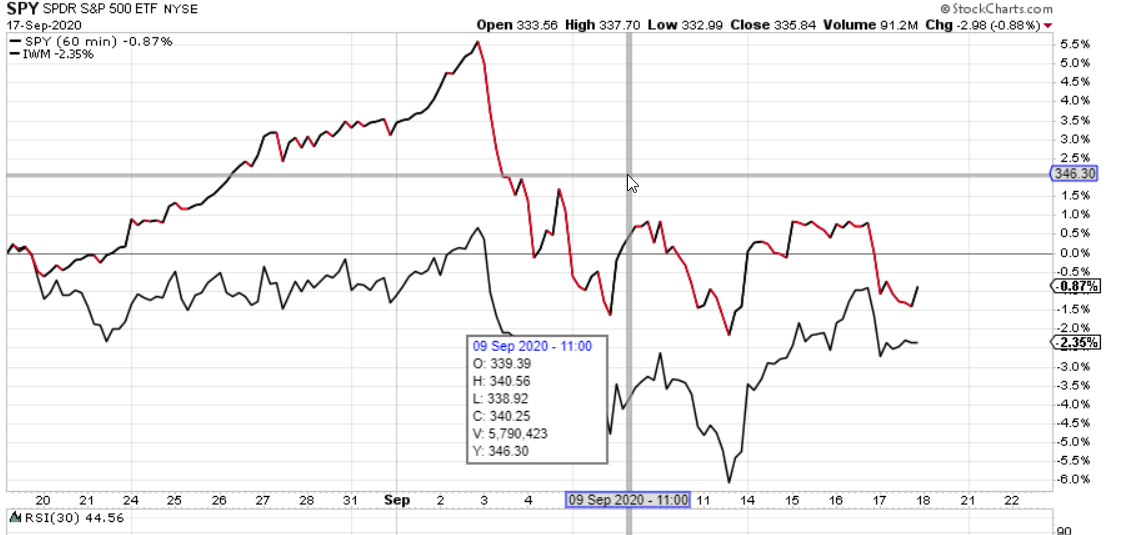

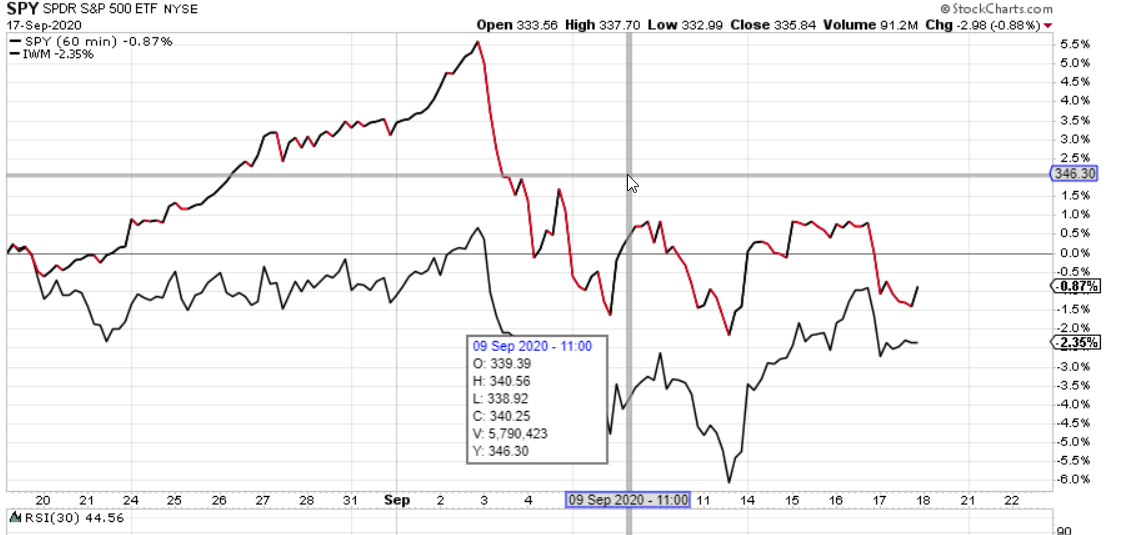

The last month has seen an enormous volatility creep into the markets, which has heavily impacted our profits. Our SPY positions have turned negative since inception, while our IWM positions continue to be very profitable.

SPY size: 16 contracts

Launched June 23, 2020

basis $46,005 or $28.75 / share

cash flow $17,895 or $11.18 / share

p&l ($16,305) or ($10.19) / share

IWM size: 35 contracts

Launched June 18, 2020

basis $93,135 or $26.61 / share

cash flow $17,895 or $11.18 / share

p&l $53,778 or $15.36 / share

We always knew that our milk-the-cow strategy is susceptible to losing money during periods of high intra-week volatility. The ensuing whipsawing causes numerous frequent small losses. Also the higher volatility leads to larger spreads between the bid and the ask, adding to the difficulty of rolling trades without a loss.

If you knew in advance when the volatility was going to incur, it would be simple to get to the sidelines, then await calmer times But the market is not always so accommodating. Often it takes a serious of significant whipsaws before you realize the new mood. And by then you may already have lost a lot.

Also, the market does not suddenly announce that it is re-entering a calmer phase. Delaying re-entry into the markets by staying on the sidelines can leave a lot of premiums to go uncollected and reduce the profitability of the strategy.

In this situation, there were 3 approaches we though made sense:

- Add up cumulative premiums losses during each week and get to the sidelines as soon as a given loss value was exceeded. For example: 70% of options premiums collected. Only get back in once volatility subsides. Subsiding volatility could be measured by bid-ask spreads and 15 minute standard deviatition measurements.

- roll automatically at market prices (instead of limit orders, which we normally use) on every 1 strike move of the underlying.

- move out our strikes much further away from the current market price. Since volatility is higher, we would end up still collecting significant premiums.

Additionally, it made sense to consider the negative impact of big overnight gaps, which would preclude us from taking defensive rolls in time, since options are not traded after hours. Here we had a choice of:

- Getting out every night just before market close. Shorting again first thing in the morning. This sacrifices the nightly theta decay, but protects you from large adverse delta and gamma losses. It also leaves your long term LEAPS susceptible to big changes in value.

- Or ... short only one side of the trade (puts or calls) based on the opposite of your long term LEAP bias. (If bullish, sell calls and v.v.)

- Leave the short position on overnight, but establish a next period matching calendar which would offset any big delta or gamma damage while preserving some theta erosion.

- Establish very skewed short term bets in both directions using proven broken-wing butterfly strategies.

In essence, we tried all of these, but on different instruments (SPY vs IWM vs GE vs BAC) and at different time.

We are still examining our data carefully , and running what if scenarios after the fact using TD America's wonderful historical options pricing tool.

But continued expected market volatility over the next few weeks does not give us the luxury of making long comprehensive studies using large data sets.

The size of our recent losses on SPY requires that we take action immediately, even if based on still scant trial data sets. (And yes, the irony of the parallel to the quandary governments face with coronavirus measures does not escape me...)

The first striking conclusions is how much more we suffered in losses on SPY versus IWM. We lost a cumulative $20,464 for 16 contracts on SPY, or $12.79 per share. This represents 50% of our original allocation! Contrast that with a $5204 loss on 35 contracts on IWM, or $1.48 per share.

This is despite the fact that the two have had comparable volatility.

So why the difference? Well with IWM we pretty much rolled automatically whenever the price made a significant move. But we only rolled when the stock had moved by at last two strike levels, as opposed to 1 strike with SPY.

Consequently, we had 148 rolls on SPY, but only 58 on IWM. Since bid/ask spreads have widened considerably in "whippy" periods, the higher number of trades results in higher losses, instead of the normally slightly superior effect of rolling frequently to minimize delta losses in calmer times.

In fairness, this was not entirely due to the poor choice of directionality. Rather on some days we accepted large losses on our short positions to hedge out a possible loss on our LEAPS. In other words, at times we accepted a loss overnight of $5000 in order to avoid a $15, 000 drop in our LEAP profits overnight. We did not need to do this on IWM, where our position was more delta neutral.

For now, our conclusions are threefold:

- measure volatility and bid / ask spreads . When these increase, move your strike levels away from center, establishing strangles instead of straddles.

- close short positions overnight if market volatility at night is very high

- take steps to neutralize your long term LEAP positions if these skew more than you intended.

- when your short term positions move against you, roll out in time as well as price, always focusing on bringing in positive premium Roll back in time whenever profits permit it.

I calculate that these periods of high volatility will occur around 3 to 4 times a year for a period of maximum 2 weeks. By taking the measures indicated below, I think we can reduce our losses during those periods to around 10% over the week, as opposed to average gains of 12-13% in remaining periods.

If that can be accomplished, the Mild The Cow strategy should be able to boost earnings from current annualized levels of 37% (15.36-10.19 )/ (28.75+26.61) to over 200%.

As always, there are no guarantees. One can only sweat the details.

[tj_options_disclaimer]