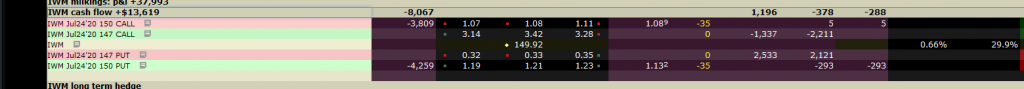

We are holding a July 24 straddle centered on 147. This is currently profitable. IWM is currently at 149.32 but has breached resistance. Appears to me it will culminate at 151.50 by middle of next week, at which point a retracement could be expected. By end of this week, will probably top out at 150.50. To maximize income will sell closer to the target, rather than the current price of 149. This is because there is little overhead resistance until 151.50, so chart should move according to normal Elliott wave patterns.

Closing existing contracts will net around $1200 profit for the day, or $0.34/sh. Selling at 150 maximizes Theta decay at 80 cents a day.

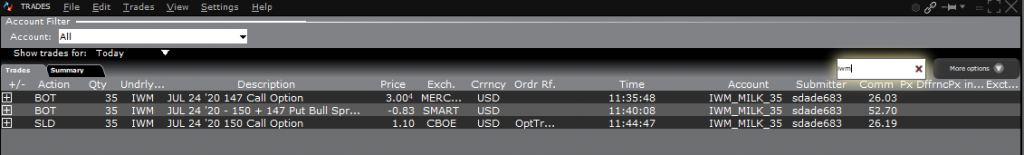

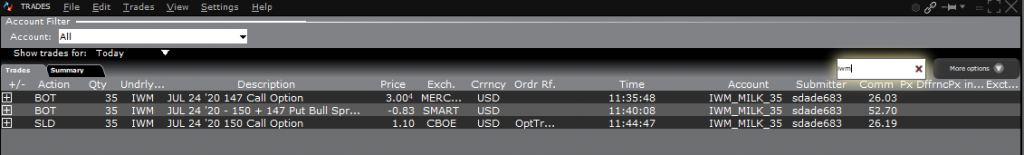

Selling 150 jul 24 straddle with limit orders. Got filled on IWM 150/147 PUT roll at 83 cents credit.

I managed this well, using a stop limit order to close the ITM calls when IWM started moving quickly up. I did not rush to sell another call.

This allowed the stock to move up another 30 cents before I sold the new 150 call, bringing in extra premium. I used a limit order to roll the 147/150 PUTs at the best possible price, instead of accepting a market price. I could not be too picky as the 150's would benefit more as the price moved up fast.

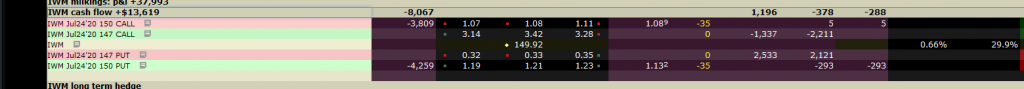

The net effect was to reduce my cash flow by $1.07 per share or $3745 for my 35 contracts. I still have a positive cash flow of $13,619 overall, or $3.89 per share. This added $1196 in profits, boosting totals to $37,993 or $10.85/share. this is 40% of my basis cost after only about 2 months of milking.