Jolt Takers

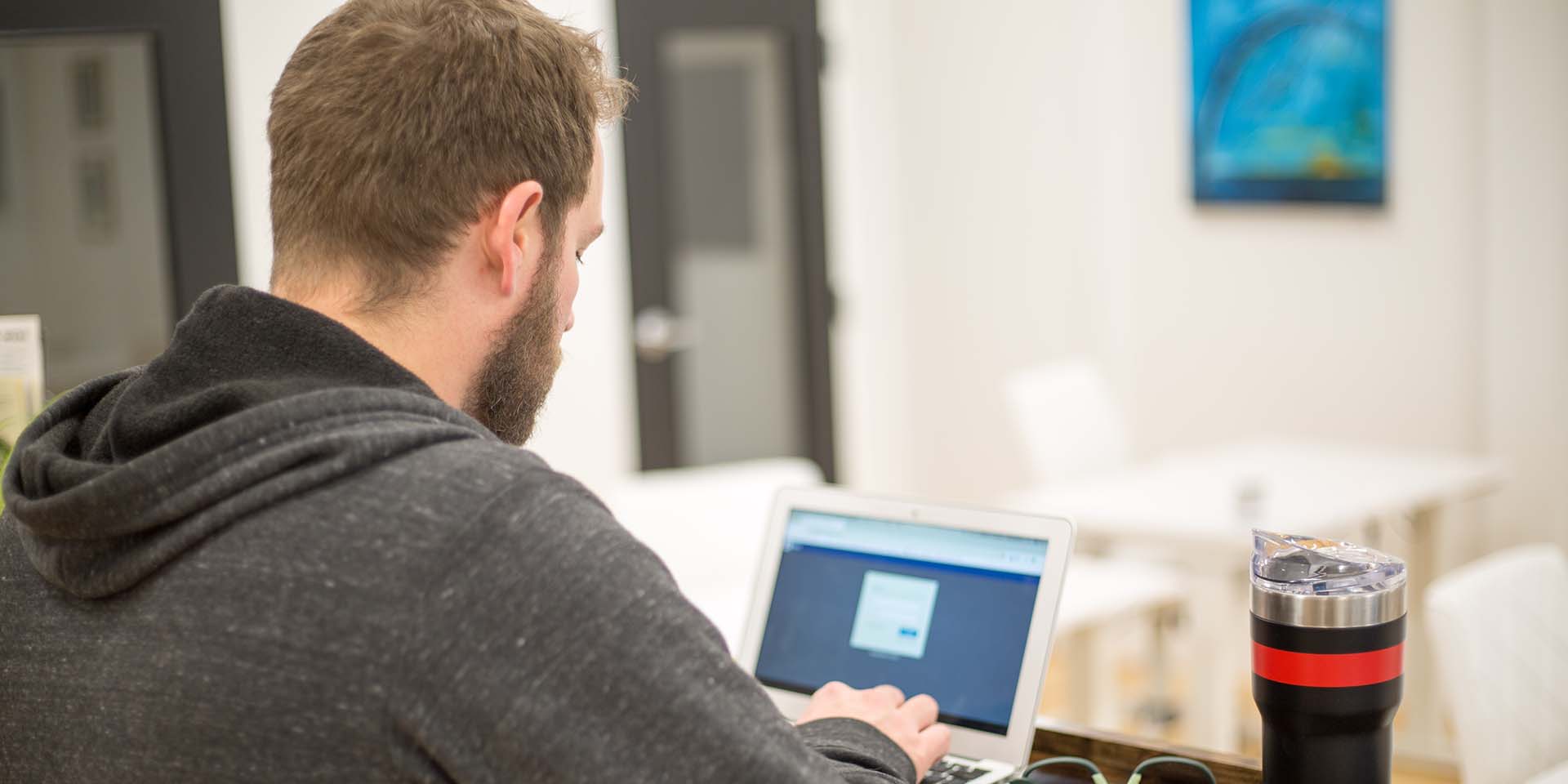

Jolt Takers are self-directed active traders who know that a hands-on, selective approach can immensely grow their wealth. They want to find great opportunities sooner, better judge risks and rewards, and tune the trades to their budgets. Jolt Takers know that better execution leads to higher profits. They'll often pay for Jolt Guidance from an expert whose credentials have been demonstrated in the Jolt Market.